Creative Ways To Make A Strategic Website Purchase

What’s Twitter worth?

To us, it’s worth $0.00.

No joke – we base our valuation of sites on a 20X multiple of monthly net profit. Due to the fact Twitter is not profitable to date (this is debatable, apparently) we wouldn’t be able to list it on our marketplace…it wouldn’t be worth anything.

But that’s not fair, is it? With all of the investment, hundreds of millions of users, and celebrity battles for followers it must have some value that doesn’t fit into the box we’ve created.

Keeping in mind that investment alone does not create value, where else can we look to find out how much Twitter is worth?

We can start by looking at their value to competitors in an acquisition.

Both Facebook and Google have the user base, infrastructure, and ad networks that would make a Twitter acquisition extremely valuable for either of them immediately. It would take some time, but a well-executed integration would add much more revenue than the annual revenue/profit that Twitter currently brings in.

That’s Great – But What Does This Have To Do With Me?

Large companies have lawyers, accountants, and mathematical wizards that can calculate estimated acquisition value and determine a fair valuation based on the strategic value of the purchase.

Small companies and websites that we deal with regularly – not so much.

This is great because it means there are a TON of opportunities out there we can use to our advantage.

In episode 72 of our podcast, we covered the six different types of website buyers – one of which was “Strategic Sally”. I wanted to cover this buyer in more detail, simply because there’s so much opportunity for all of us on the lower end of the spectrum.

Strategic purchases on a micro-level present a ton of opportunity for the savvy business owner and we’re going to walk through the process of determining value, finding strategic targets, and reaching out to get the ball rolling.

What Is A Strategic Buyer?

Many strategic investors couldn’t care less about the stand-alone revenue of a potential acquisition target. Instead, they’re looking at the potential boost or lift they’ll receive in their current business by taking over the target’s assets, products, and/or customer base.

They may or may not be actively seeking out strategic acquisition targets, but they understand the value of building up their cash reserves or war chest so that they can act quickly when an opportunity presents itself. Take a look at Mark Cuban’s thoughts on having cash and war chests here.

Most strategic buyers are already in the niche as a competitor or offer complimentary products/services to their strategic target.

How Do I Value A Strategic Purchase?

It’s much easier to evaluate strategic purchases with public companies and a team of experts on your side, but you can apply some of the same strategies to micro-targets as well. Here are a couple of questions to keep in mind:

How much would it cost to replicate?

For publicly available sites for sale, enough information is usually given to determine a reasonable estimate as to how expensive it would be to completely recreate the website and compete directly. There are courses and walkthroughs out there that explain exactly how to find and replicate publicly available Flippa listings, but I wanted to share a few of the comparisons you should look at:

What are the hard costs to replicate?

- Content Costs: How much would it cost to completely have the content recreated? 100, 600-word articles from a “Skilled” writer at HireWriters.com? $750.00. 200, 1K word articles from 4-star writers at Textbroker? $4,800.00. 10 KISSMETRICS level infographics? $6,000.00.

- Linkbuilding Costs: What does their backlinks profile look like? Could you replace it with a basic $100 linkbuilding package? A more-involved $2,000 package? A full-on $20,000 SEO package?

- Suppliers/Inventory: What are the minimum orders? How much inventory do they have on-hand today and how much would that cost? How much would you need to stock to be competitive?

- Partnerships/Affiliates: How much would it cost you to hire an affiliate manager to promote to the same affiliate audience or better? Do you have partnerships in place that you can leverage from day one?

- Leads/Subscribers: How responsive is their list? How much would it cost you to acquire similar subscribers?

- Trial/Paid Customers: Work out what it costs them for a paid customer and then look at their trial-to-paid conversions. Do you have resources or traffic sources that can do that or better? How can you drop acquisition costs if you acquire this company?

That list is not exhaustive, but should point you in the right direction to determining the hard costs to recreate the site or business from scratch.

[callout]“If you determine the hard costs + opportunity costs are more than the price of the site, it may make sense for you to buy rather than start from scratch.” – Tweet This![/callout]But – hard costs aren’t the only thing you need to look at.

You also have to look at the time involved to go from nothing to completely replicating the business:

— What will the time required cost you in terms of losses in your current business?

— How much would it cost you to have someone else build it from scratch for you, if you determine the costs to your business are too high? Do you have someone in place that can do that or would you have to find and hire that person?

— How long would it take you to catch and surpass the current site? What’s the difference in revenue/profit between the two sites during that time?

— How valuable is the brand of the target site today? What would you lose by playing catch up?

If you determine the hard costs + opportunity costs are more than the price of the site, it may make sense for you to buy rather than start from scratch.

Where Can I Find Strategic Acquisition Targets?

Well that is the trick, isn’t it?

Our portfolio investors are regularly checking out sites for sale on our marketplace and looking for good additions, but it’s not so easy for strategic buyers. Our sites for sale cover a wide range of industries, monetization methods, etc. It’s analogous to finding the proverbial needle in the haystack.

If you can get this figured out and create a process that works you’re well on your way to mini-moguledom. Here are a few different approaches you can test to see which works for you.

Speak Up – Let Everyone Know

[callout]“The benefits reaped are likely to outweigh the risks of sharing your next moves.”[/callout]You can announce this on your blog, in community forums, in your mastermind meetings or calls, to mentors, etc. Getting the word out will let your competition know that you’re in the market for a purchase. If they are looking to sell you’ve now opened the door for them to come to you and start the discussion or negotiation.

This may not be the approach for a very large, publicly traded company in an established industry. (Debatable, but that’s for a different post) They’re aggressively competing and telegraphing their moves could be a costly mistake.

But – for the rest of us – this is your best bet for finding great strategic targets.

Why? Simply put – your competition isn’t likely to be strategic enough to take advantage of your transparency.

The benefits reaped are likely to outweigh the risks of sharing your next moves. – Tweet This!

For example, Joe and I made it known in our circles that we were looking to acquire small outsourcing contracts in the Philippines. Just mentioning this to a few friends and colleagues brought us two separate deals, one of which we were able to close.

Co-opetition

Your best opportunities will often come from within your niche or industry and will require the insider knowledge you already have to capitalize. Still, you’ll have to keep up on what’s going on in your industry and with your competitors to take advantage.

This isn’t always a possibility as some entrepreneurs view everyone else in their space as a danger or risk, but if you can break down those walls and open up the conversation you’re likely to be much more informed than the competitors that don’t. Forming these relationships can build alliances that let you shut out and crush the competition that doesn’t get onboard. (Machiavellian, I know)

Buyer-Side Brokers

Similar to the Real Estate industry, many online brokers have buyer-side contracts where they will take your requirements and dig through the market for you to find something that matches. This typically includes an up-front payment to the broker doing the work, so you’ll want to really be on the market before getting started.

Less formally, you can let a few brokers know what you’re looking for and if a site comes along that matches your requirements, they can shoot you an email to let you know it’s now available. (This is something we do for our site buyers today)

How Do I Approach A Strategic Target?

Your approach is going to vary, depending on whether you know the target is available or not.

For Targets Not Available

Think of the process like a sales funnel. You’re better off spending very little of your time at the top or the entrance path – too many discussions, unfruitful work, etc. Instead, create a checklist of requirements and a process for weeding through them.

As an example, let’s say I run a social media management company. I know that tools, apps, and plugins are valuable lead generators for my business, but I’d rather buy one that’s already running than build one from scratch. I may look for things like:

+ 5K – 50K downloads

+ 4 Star Rating Or Better

+ Recent Reviews (With at least 2 gushing about the plugin)

+ Updated Last 6 months (Or maybe not? Might be worth targeting those that need some refurbishing)

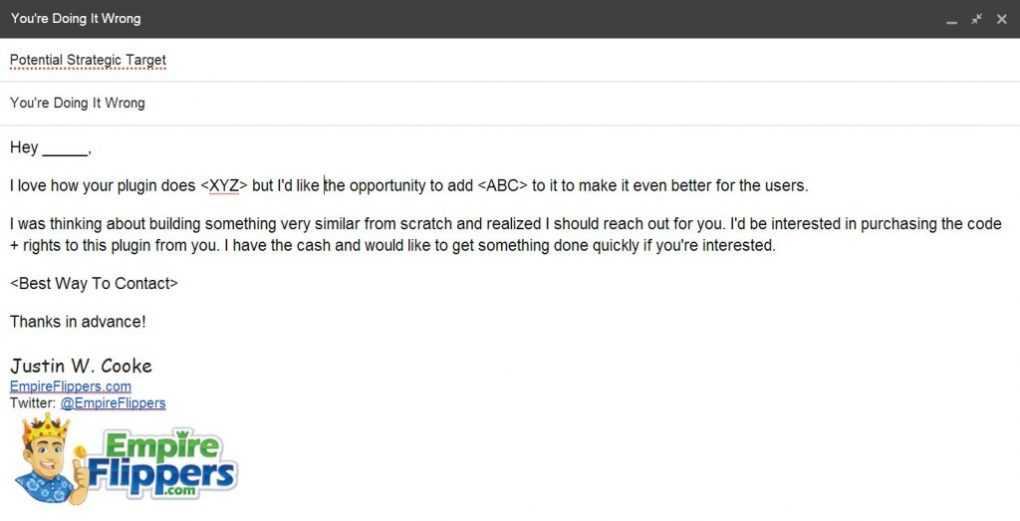

I would then use a cold email technique our friend Damian Thompson shared with me:

The more specific you can be in the first paragraph, the better luck you’ll have. You’ll want to avoid looking like spam or saying the exact same thing in every email. The rest of the email can be the same each time, but grab their attention early with specificity.

The idea here is to do the first 5-10 yourself to check your results and then adjust your requirements and email. Once you have the process down you can transfer the entire Top-Of-Funnel process to a Virtual Assistant. That way, you’re only getting involved when the owners of the plugins actually respond with interest. (Have your VA weed through and dismiss any other responses)

Once the target has expressed some interest, you can go through the process outlined in the next section knowing that there’s potential for a deal here.

Targets That Are Available

[callout]“Every step a site buyer should take should be to disqualify the target based on well-reasoned analysis.” – Tweet This![/callout]It’s harder (luckier?) to find targets that meet your parameters and are available for sale right now, but let’s say you happen to stumble across one. Hopefully, you’ve built up the cash reserves or war chest mentioned earlier and are in a great position to strike.

Before you do any deep diving, it’s worth asking a few questions and getting a general feel for what you’re getting into before moving forward.

Any obvious signs this is a scam?

Can I leverage my current resources to add value?

Is there a clear path to success here?

Will this acquisition making an immediate impact on my business?

Do I have the time required to focus on making this a success?

Remember, you have the power as the potential buyer here – you’re looking for reasons to quickly/easily disqualify the target so that you can move on to the next one.

Every step a site buyer should take should be to disqualify the target based on well-reasoned analysis. – Tweet This!

[callout]“Giving away too much is likely to cause the seller to see dollar signs and want a piece of your upside. That’s not his to have.”[/callout]Once the target has passed your initial checks, it’s time to go a bit deeper. Here are a few tips to go along with your due diligence:

Pay/Sign-Up For The Product/Service – Anonymously, if possible. Don’t bother taking the seller’s offer of free, they’ll likely give you a white-glove treatment that won’t be indicative of a typical sale. You’ll want to know what the “average sale” looks and feels as it will give you great ideas on strengths, weaknesses, where to improve, etc.

Get Feedback From Current Customers And/Or Peers – Don’t mention that you’re looking to purchase and see what kind of feedback they have for you. Are they likely to find value? Do they see immediately how the product/service fits into your business and aligns with what you’re doing?

Reach Out To Customers With Testimonials – How closely do they match your current/ideal customer? What products/services do you currently offer that would be of interest to them and provide them value? How can you double or triple their current Lifetime Value (LTV) with the target, considering the new suite of products/service they’ll have access to?

How Do I Make An Offer?

There are no guarantees or blueprints to success here, but it’s helpful to consider the seller’s motivations:

- They’re bummed the idea didn’t take off – Maybe it’s a relief you’re taking this off the seller’s hands. They might be surprised they’re able to get anything for their idea at this point. Offer low and make the sales/transfer process as frictionless for them as possible.

- They have big plans and are reluctant to sell – You’re likely to pay more here, but the strategic value to you might still outweigh their unrealistic expectations. Stick to (and point out) industry averages of multiples of net earnings and leave the upside (and risk) for yourself.

- They are shopping it around to your competitors – If it’s a sweet deal and something you don’t want your competitors to have, make a healthy cash offer upfront with a ticking clock attached. Press urgency and show you’re serious, but be willing to stick to your guns when the timer hits zero.

There’s no reason to over-share your plans. (I’ve definitely been guilty of this) Giving away too much is likely to cause the seller to see dollar signs and want a piece of your upside. That’s not his to have. If you’re still in idea phase there’s no telling how this will all play out so there’s no value in sharing too much.

A Strategic Purchase I’d Like To See Happen

Market Samurai

They used to be the crown jewel when it came to keyword research but we’ve seen them fall in recent years, opening the door to competitors like LongTailPro and others. It’s unfortunate – I’ve always thought MS seemed like much better software than LTP, but it just didn’t meet our needs as well. I’m now seeing IM affiliate offers come out of the Noble Samurai brand that don’t seem to match their authority in the space.

My guess is that they built up quite a bit of bloat in their prime and are now struggling to innovate with their software – especially considering the fact that most of their sales came through a fixed-priced product and were heavily split with affiliates.

There would be quite a bit of work to refurbish the software, re-establish the brand, etc. Still, I think a savvy SaaS team with an online marketing background could pull out some real value here. Market Samurai comes with a well-known brand and amazing customer list that would be well-served with added, complimentary products and services.

Did you like this article? Give us a shout on Twitter!

Any strategic purchases you’d like to see happen? Any personal experience or case studies you can point to that help (or debate) our points? Let us know in the comments!

Discussion

Gang buster tips here, Justin. One of the things you mention which I believe a lot of folks overlook is the similarity between income producing physical real estate. (and other “conventional” investments) and income producing web properties (Virtual Real Estate)..

Example: I’m currently looking hard at a duplex in Florida which brings in (gross) about $2000 a month. It’s priced at $168,000.

Physical real estate used to be considered a very “safe” investment, but we all know how wrong that has been in the past 6 years or so.

Buying several web businesses (mainly for diversity) which add up to $2000 a month should only cost me in the range of $40,000 based on your x20 yardstick.

Let’s see … $168,000 to gross $2000 a month or $40,000 to gross $2000 a month. Wonder which investment makes the most sense?

Of course buying websites instead of Florida rental property means I won’t have to declog toilets in the middle of the night, or having a tenant turning the place into a crack house and such.

I guess you call that an “intangible” benefit in favor of “virtual” real estate?

Thanks for sharing, Tim!

That seems like a pretty solid strategy. You can especially find some bargains/deals for sites that have the traffic in the niche and aren’t monetized, I’d imagine. They’re happy to get a $5K offer at all for their site, not knowing the guy purchasing is spending $2K/month for leads JUST like the traffic they’re currently receiving!

BTW – I think there’s something here if you weren’t doing it for clients and, instead, were building a lead generation company.

Say (for example) you setup a price-per-lead with either a national brand or even a middle-man that advertises for the particular niche. You then snatch up related sites and build email lists, start funneling those visitors into leads you can sell at $$ per lead, etc.