State of the Industry Report 2023

Section 1: Introduction

Welcome to our State of the Industry Report for 2023!

This is a major report that we release every year, which analyzes the market trends in the online business buying and selling world. Every year, we see what sold the previous year and compare that data with the previous industry reports we’ve completed.

This year’s report is particularly important given the drastic shifts in the market that we feel haven’t been honestly or fully communicated by others in the online M&A brokerage space.

We’ve reviewed 1,493 business deals over the last five years, and it’s clear that the post-pandemic M&A market of 2022 and beyond has shifted into a very different landscape from 2020 and 2021. We believe it’s crucial to shine a light on this reality by providing a transparent analysis of our data on the market’s current state, trends, and future projections.

If you’re new to the world of online business M&A world, and would like a more detailed breakdown M&A terminology including how online business valuations are calculated, here’s a free copy of the State of the Industry 2021 report.

To start us off, let’s get straight into the core takeaways from our analysis.

Section 2: Core Takeaways – Market Normalization and The Reality On the Ground for Sellers

The overarching conclusion we’ve drawn from the data is that the market is normalizing after a 2021 peak. The peak was more prominent for certain business models over others, but regardless, we believe we’re now seeing longer-term stabilization, and that market conditions of 2020-2021 are likely not returning.

For the market conditions of 2020-2021 to happen again, we would need to see:

- A world-changing event, such as a pandemic, that would fundamentally shift consumer online buying patterns and drive exponential online business growth with a specific business model.

- Highly liquid aggregators competing with each other for these types of businesses.

- A scenario that makes less risky assets less desirable (i.e. real estate and rental income being negatively impacted during the pandemic).

The probability of these three scenarios playing out at the same time within the next 1-10 years is highly unlikely.

All to say, we believe that the ideal path forward is to sell for a life-changing exit today rather than waiting for something that may never happen.

Seeing Eye-to-Eye with Buyers During Negotiations

Despite this, many sellers on our marketplace continue to insist on listing at 2021 valuation levels and are holding out for a supposed wave to return.

Holding onto valuation expectations of the past has created a misalignment in the market, where sellers are unwilling to lower their valuation multiple and buyers are unable to justify purchasing businesses at the proposed valuations.

This misalignment can create distrust between sellers and buyers during negotiations, and ultimately lead to longer sale times or deals not going through at all.

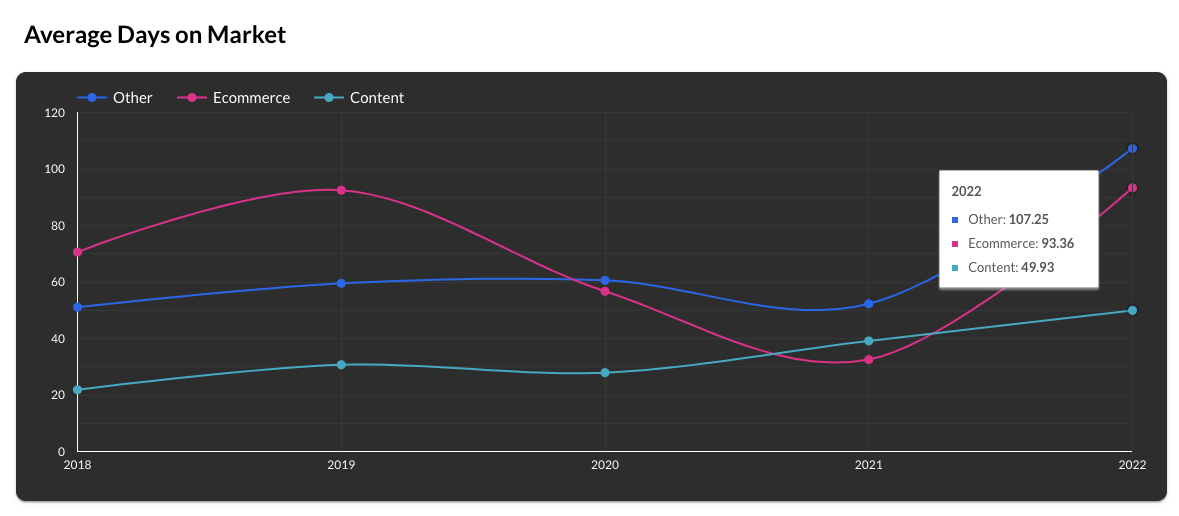

To illustrate this point, below we’ve tracked the average days on the market for each major business model, from 2018-2022:

In 2021, eCommerce businesses sold on average within 32.56 days after being listed on the marketplace. The length of time almost tripled in 2022, increasing to 93.36 days on the market, nearly returning to the average in 2019 of 92.5 days.

Content sites were on the market for an average of 39.15 days in 2021, and increased to 49.93 days in 2022. This business model represents the lowest number of days on the market of any business model, though there is a gradual increase from the 2018 and 2019 averages of 21.86 and 30.71 days respectively.

Overall, 2022 marked the highest days on market for every business model, indicating buyer resistance or hesitations to purchasing. It’s clear that this has become more of a buyers market, and sellers will likely need to be more flexible during the negotiation phase to sell their business.

Aside from being flexible on valuation multiples, deal structuring is another way sellers can improve the likelihood of a successful exit.

Deal Structuring and Lowering Buyer Resistance

One tool that sellers have available to them to reduce buyer hesitations during negotiations is in leveraging an earnout as part of the payment structure.

An earnout means essentially anything that isn’t 100% of cash paid upfront for a business after it’s sold.

Earnouts either exist as fixed (time-based) earnouts or performance-based.

A fixed earnout is a time-based earnout, where the payment is not associated with a business meeting performance thresholds, but rather paid out over an agreed period of time. An example of this would be 70% cash paid upfront for the business, and the remaining 30% paid out in monthly payments over six months.

A performance-based earnout is paid out when a business meets specific performance thresholds. An example of this could be where 70% of the business is paid for in cash, and 30% is paid out once a specific revenue threshold is hit.

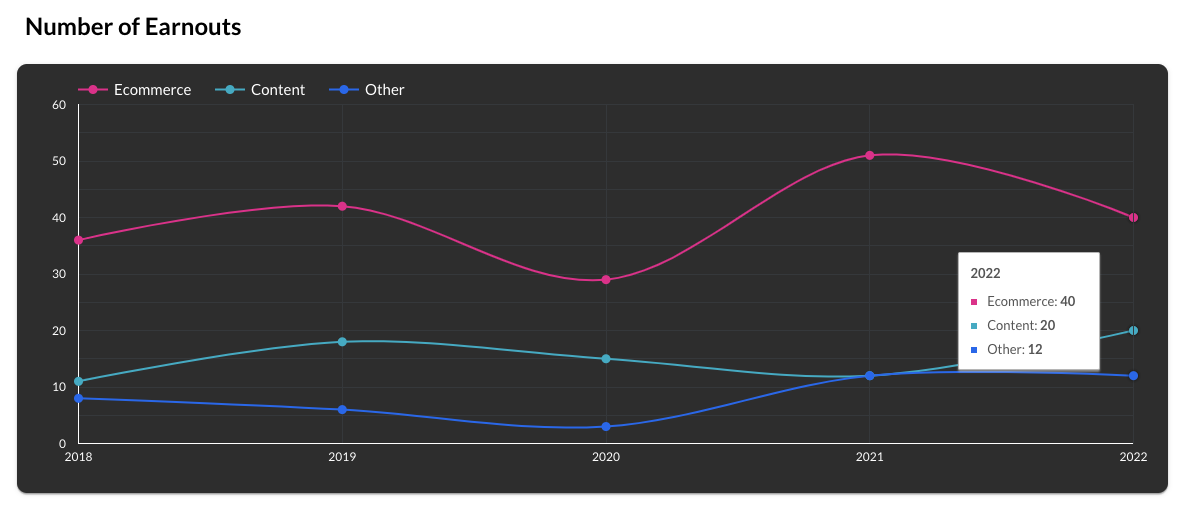

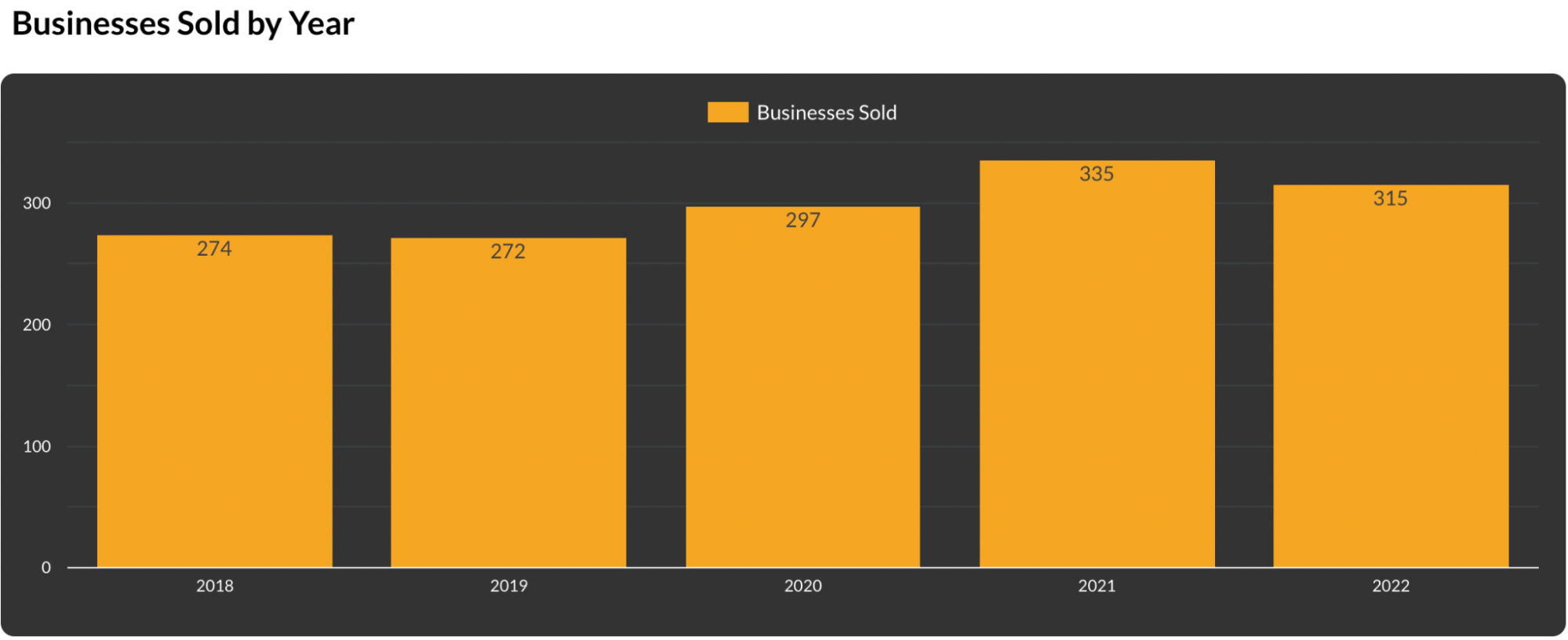

Earnouts are becoming more common for certain business models and for certain sizes of businesses. Below, we’ve tracked the number of deals that have included earnouts, across the major business models from 2018-2022:

In 2021, eCommerce business deals saw a record-level 51 earnouts. This dropped to 40 earnouts in 2022. This drop can be in part attributed to fewer eCommerce businesses sold in 2022.

Content site business deals closed with 12 earnouts in 2021, which increased to 20 earnouts in 2022. Opposite to the trend with eCommerce businesses, this jump can be attributed to the larger number of content sites sold in 2022 compared to 2021.

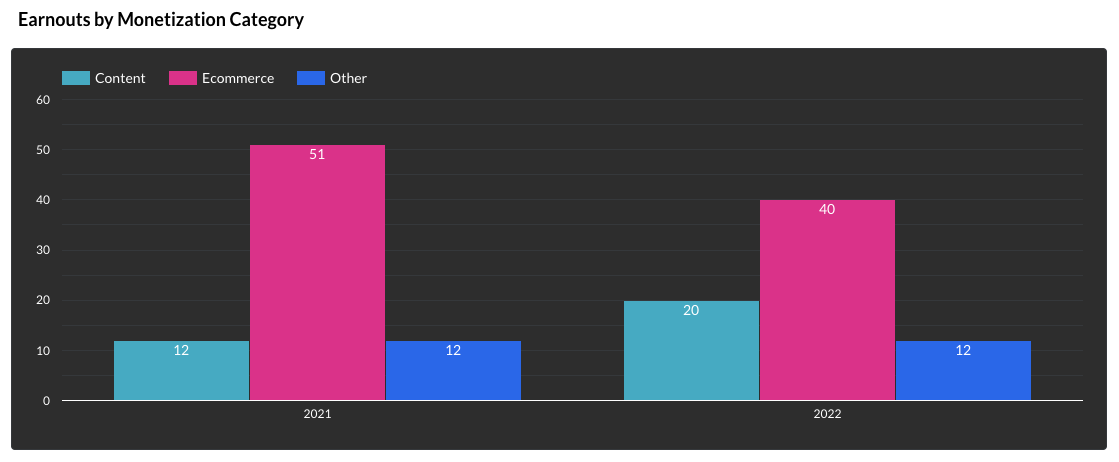

Earnouts were also more or less common depending on the size of the business. Below shows the number of business deals associated with earnouts by four major business price tiers:

For sub $300k businesses, out of the 225 sold in 2021, 9.33% of the business deals had earnouts associated with them. In 2022, this increased to 13.92%. This category represents the lowest number of deals with earnouts.

For $300k-$1M businesses, in 2021, 41.89% of the business deals had earnouts associated with them. In 2022, this increased to 43.08%. There were overall more deals associated with earnouts in this category, but a smaller percentage when compared to $1M-$5M business deals.

For $1M-$5M businesses, in 2021, 66.67% of businesses had earnouts associated with them. In 2022, this increased to 83.33%. This category represents the highest number of deals with earnouts.

For $5M+ businesses, in 2021, 33.33% of businesses had earnouts associated with them. In 2022, this increased to 100%. The large difference in these percentages can be attributed to the small sample size of business deals in this category.

Overall, the likelihood that business deals will be associated with earnouts increases with higher business pricing tiers.

Insight from our Sales Advisors About Earnouts

Among the many roles that our sales advisors perform for buyers and sellers, one is that of serving as an intermediary during negotiations, which includes advising on ways to structure an earnout to get deals across the finish line.

The earnout structures differ mostly depending on the deal size and type of buyer.

Earnouts for most sub $1M business deals tend to follow a basic 70/30 or 80/20 earnout structure with guaranteed (non-performance-based) payments. This may be due to more non-institutional buyers acquiring businesses at this level.

That said, some non-institutional buyers are purchasing deals with more leveraged earnouts, with as low as 50% paid upfront, and 50% paid as an earnout. It’s also common for institutional buyers still in the space to purchase businesses with a standard 70% paid upfront and 30% paid as an earnout.

Overall, the majority of earnouts appear to follow a basic structure, though there are instances where businesses needed more leveraged earnouts to successfully close.

To show how we’ve arrived at our conclusions, next is a breakdown of the data that goes into further detail on how each business model has performed in 2022 compared to 2018-2021, and the implications for sellers, buyers, and builders of each type of business.

Section 3: Trends – What Kinds of Businesses Did We Sell?

In our analysis of the data, we focused on how the current market looks compared to two major timeframes: “pre-pandemic” and “during-pandemic”.

First, we’ve calculated the 2021-2022 percentage incline or declines to analyze how the market has trended year-over-year.

Second, we’ve calculated the percentage difference between 2019 and 2022, to analyze the trend pre-pandemic and post-pandemic as a way of removing the outlier surge of online business activity experienced during the height of the pandemic in 2020 and 2021.

We believe this second comparison more accurately forecasts the direction of the market for each business model in the years to come.

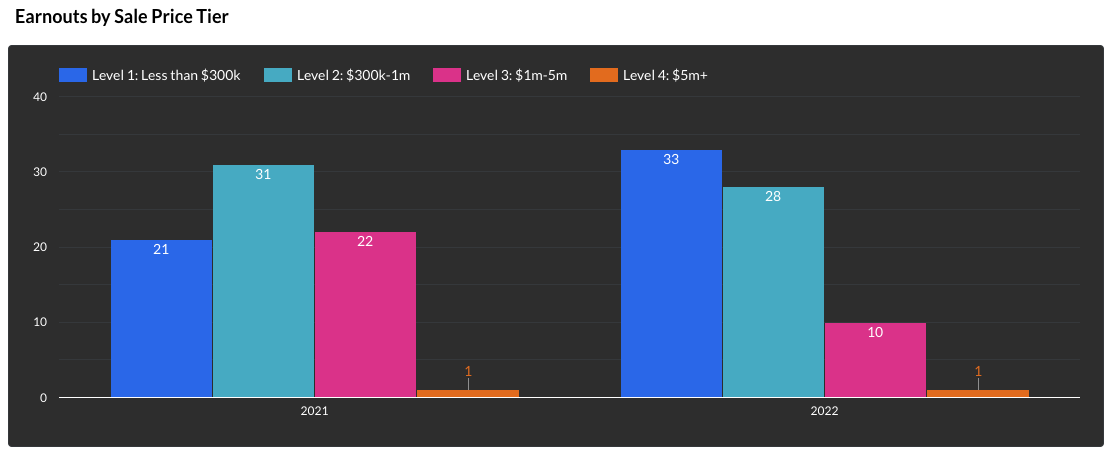

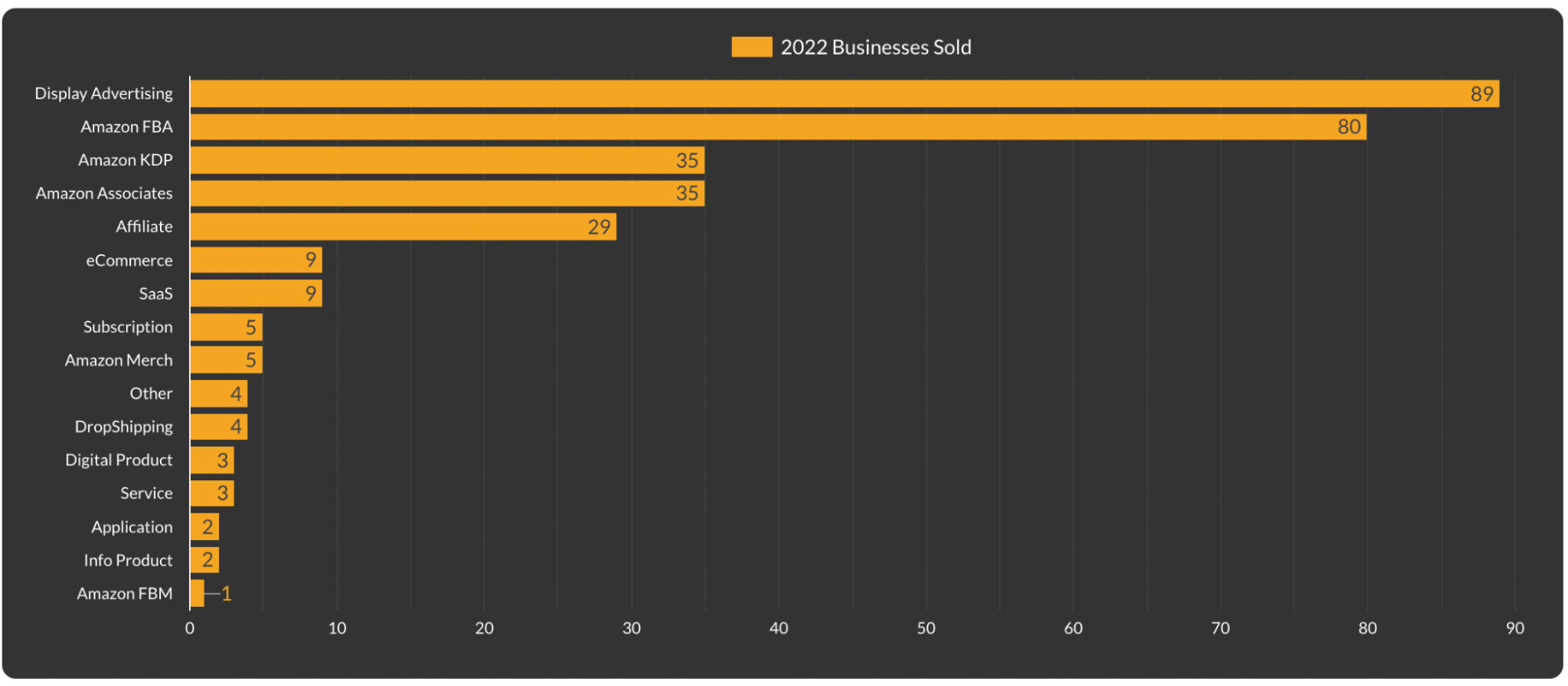

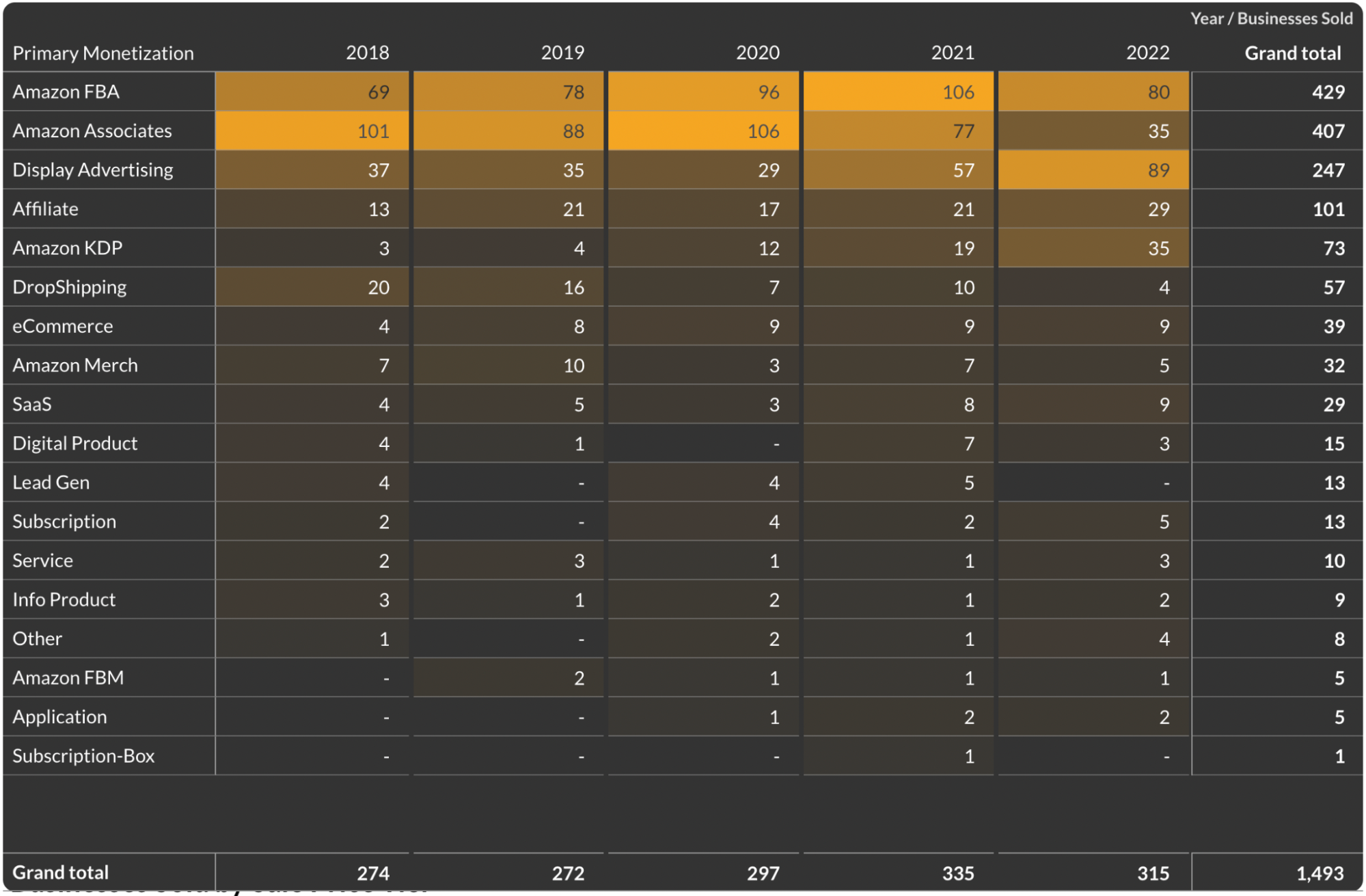

To start us off, let’s look at how many businesses were sold each year, from 2018 to 2022:

In 2022, we sold 315 businesses. This is a 5.97% decrease from 2021 to 2022, however, a 15.81% increase from 2022 compared to 2019.

While 2022 has experienced a decline when compared to 2021, the post-pandemic market has still experienced a significant increase when compared to pre-pandemic market conditions.

If 2021 was the year for Amazon FBA businesses, 2022 was the year for content sites.

In 2022, content sites outsold every other business category, selling a total of 153 businesses. Within content sites, display advertising businesses were notably the most attractive acquisition. At 89 businesses sold, display ad-focused websites were the best-selling business model of all businesses.

The second highest-selling business category was physical product businesses (Amazon FBA/FBM and eCommerce), with a total of 94 businesses sold.

The third-highest-selling business model, and the business model with the most significant year-over-year increase, was Amazon KDP, at 35 businesses sold.

All remaining business models accounted for 33 businesses acquired.

Below, we’ll go deeper into how acquisitions for each business model have trended over the last few years:

eCommerce Businesses

Amazon FBA

From 2021 to 2022, we saw a 24.5% decrease in purchase volume for Amazon FBA businesses. This sharp drop reflects the halt in buying activity from Amazon FBA aggregators. When comparing 2019 to 2022, however, we still saw a 2.56% increase in purchase volume, indicating that there is an increase in buyer activity outside of this aggregator pool.

In 2021, there were 106 Amazon FBA businesses sold, accounting for 31.64% of all businesses sold in the year. In 2022, Amazon FBA business sales accounted for 25.40% of all businesses sold.

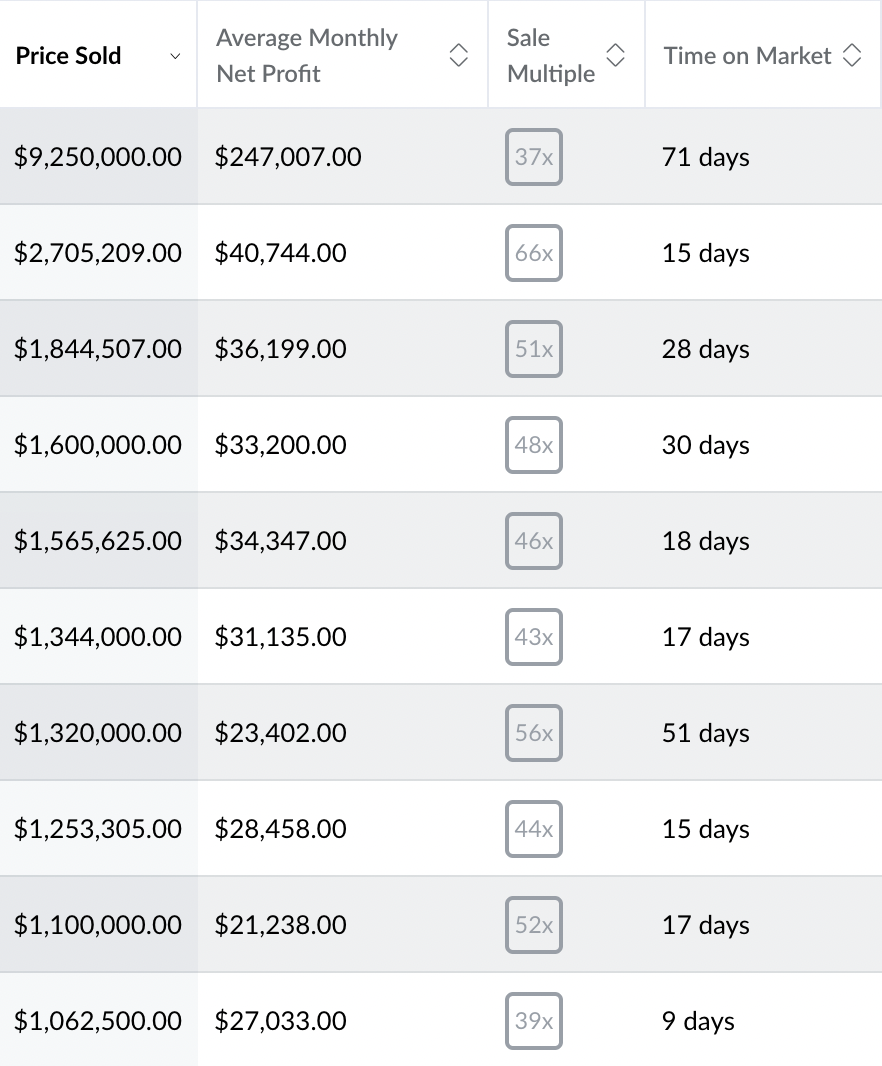

While overall Amazon FBA sales declined and also accounted for a smaller percentage of total businesses sold, there were still some large acquisitions.

Below is a chart showing the 10 largest Amazon FBA sales of 2022:

While there were still several 7-figure deals, all deals except the top deal were sold for low 7-figure amounts. The average sales multiple was 48.2x and the average time on market was 27.1 days.

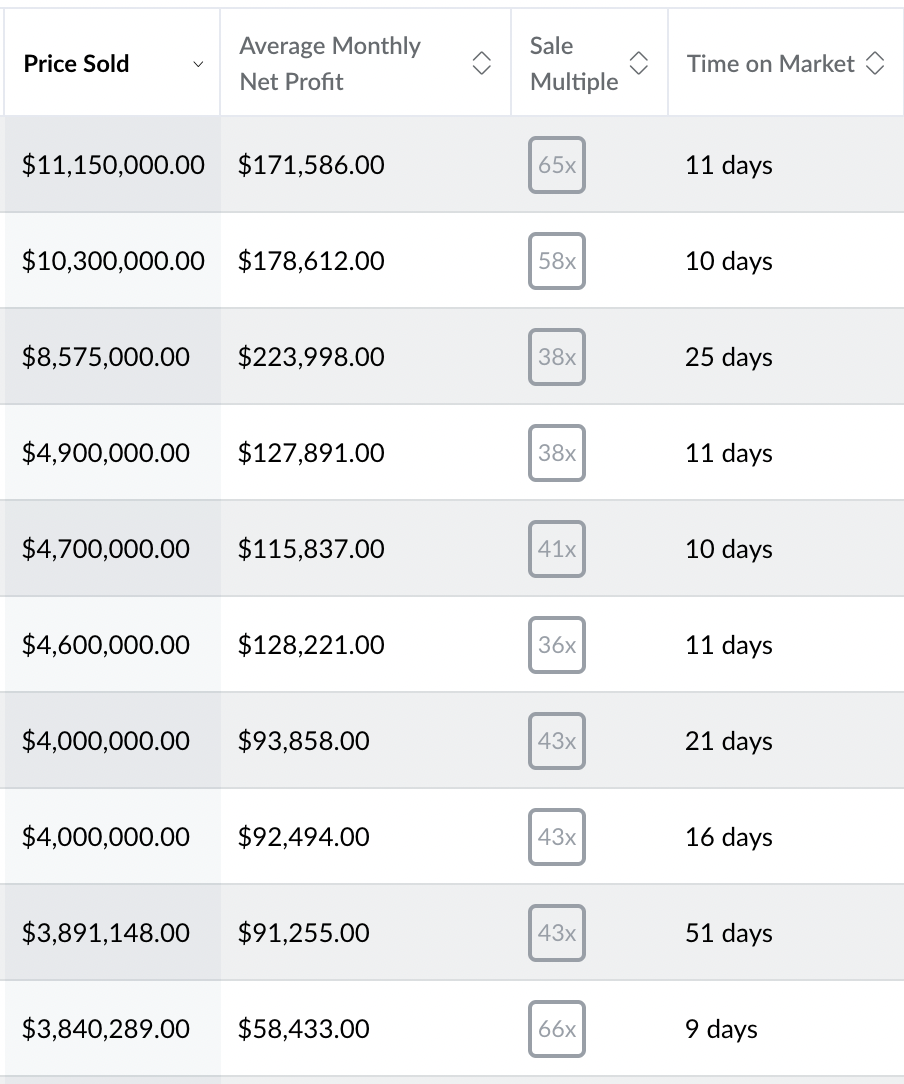

Let’s compare this to last year’s top 10 largest Amazon FBA deals:

Several of the top deals were sold for mid to high 7-figures, with the top two deals selling for 8-figures. The average sales multiple was 47.10x, which was actually 1.1x lower than in 2022.

While the average sale multiple was slightly lower, businesses were on the market for an average of 17.5 days, or 9.6 days shorter in 2021 than they were in 2022.

Strong Amazon FBA businesses were still able to negotiate high sales multiples, though it’s clear that fewer businesses are being purchased at the higher end, and that deals overall are taking longer to close.

Content Sites

Amazon Associates

From 2021 to 2022, we saw a 54.55% decrease in the purchase volume of Amazon Associates-focused content sites. Demonstrating an even sharper decline, when comparing 2019 to 2022, we saw a 60.23% decrease in purchase volume. This continued decline is likely due to the Amazon Associates commission rate reduction in 2020, which made sites monetized primarily through this sales channel far less profitable for several niches.

Display Advertising

In an almost mirrored contrast to Amazon Associates sites, from 2021 to 2022, we saw a 56.14% increase in purchase volume for display advertising-focused content sites. With Amazon Associates becoming less profitable and with display advertising being in most cases an immediately accessible monetization option for content sites, it would make sense that sellers would focus more on this channel and that buyers would gravitate towards acquiring these types of content sites. Adding to this narrative, when comparing 2019 to 2022, we saw an even greater difference with a 154.29% increase in purchases of display advertising businesses.

Private Affiliates

From 2021 to 2022, we saw a 38.1% increase in the purchase volume of private affiliate-focused sites. Growth has remained stable when comparing 2019 to 2022, with the same 38.1% increase in purchase volume.

Other Businesses

Amazon KDP

Amazon KDP has seen an exponential increase in acquisition interest since 2019. From 2021 to 2022, we saw an 84.21% increase in the purchase volume of Amazon KDP businesses. When comparing 2019 to 2022, we saw a 775% increase in purchases of Amazon KDP businesses.

This may be in part due to a market shift away from businesses that involve physical inventory management. However, the significant spike in Amazon KDP interest in particular was likely primarily driven by the Empire Flippers Referral Program. Launched in early 2022, influencers in the Amazon KDP space joined the program and educated their audience on buying and selling Amazon KDP businesses via our marketplace.

SaaS

From 2021 to 2022, we saw a 12.5% increase in purchase volume for SaaS businesses. When comparing 2019 to 2022, however, we saw an 80% increase in purchase volume.

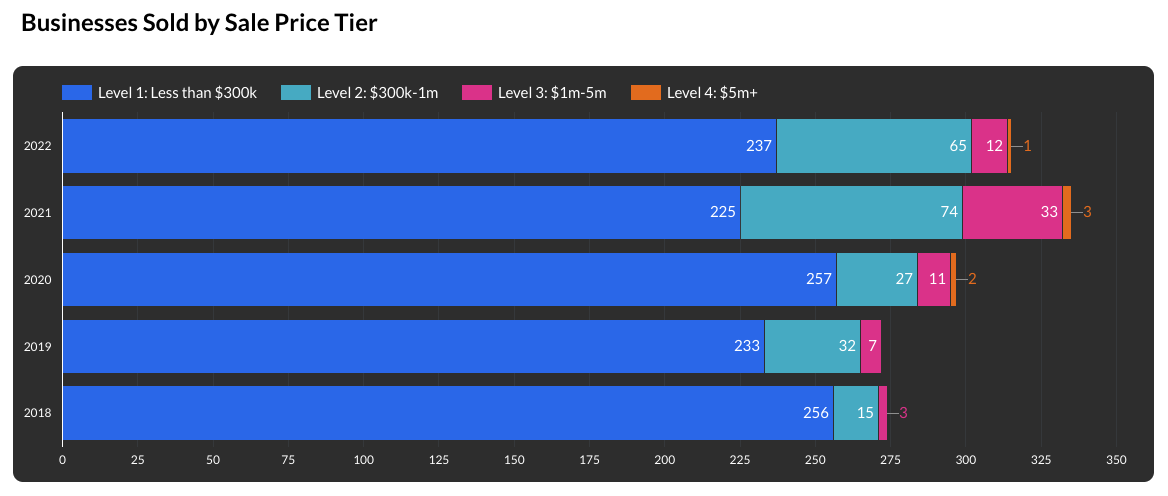

Similar to business models, business price tiers have also varied in popularity. Below is a graph showing the total number of businesses purchased from 2018-2022 according to four major price tiers:

Sub $300k Businesses

From 2021 to 2022, we saw a 5.33% increase in purchases for sub $300k businesses. When comparing 2019 to 2022, we saw a 1.72% increase in purchases. In 2021, we saw the lowest number of sub $300k businesses sold within the 2018-2022 timeframe. This is likely due to the massive online business performance spikes, which led to increased valuations during the pandemic, and sellers saw an ideal opportunity to exit as the market was acquiring these businesses as quickly as possible.

$300k-$1M Businesses

From 2021 to 2022, we saw a 12.16% decrease in purchases for $300k-$1M businesses. However, when comparing 2019 to 2022, we saw a 103.13% increase in purchases. These two figures demonstrate a return to normalized sales levels after the outlier year that was 2022, but we’ve seen significant growth in market appetite for online businesses of this size since 2019.

$1M-$5M Businesses

From 2021 to 2022, we saw a 63.64% decrease in purchases for $1M-$5M businesses. When comparing 2019 to 2022, however, we saw a 71.43% increase in purchases. Further reflecting the end of the aggregator buying frenzy, we saw far fewer 7-figure+ deals in 2022. We’ve seen steady growth, however, since 2018 and 2019, when 7-figure+ deals were a relatively new occurrence in the Empire Flippers marketplace.

$5M+ Businesses

From 2021 to 2022, we saw a 66.7% decrease in purchases for $5M+ businesses. There were no $5M+ businesses purchased in 2019, with one $5M+ business purchased in 2022. These percentage changes reflect an admittedly small sample size, where we had three $5M+ businesses sold in 2021 and only one in 2022. All of the $5M+ businesses sold were Amazon FBA businesses, and all were purchased by aggregators. As several aggregators have paused acquisitions and are focused now on operating and growing their existing portfolio, we expect to see a continued decline in purchases of $5M+ businesses, and this will likely last until Amazon FBA business growth rates resemble pandemic levels or if we begin to sell more of a different business model (i.e. SaaS or DTC eCommerce).

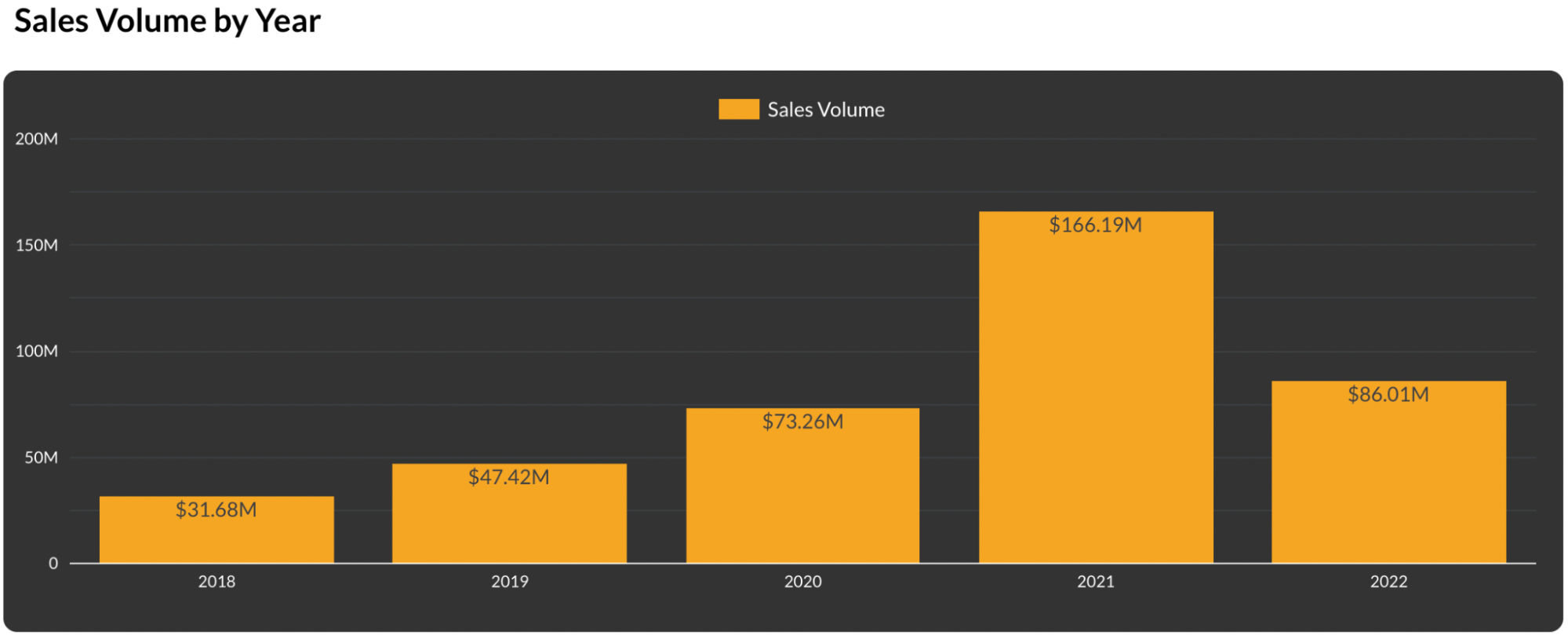

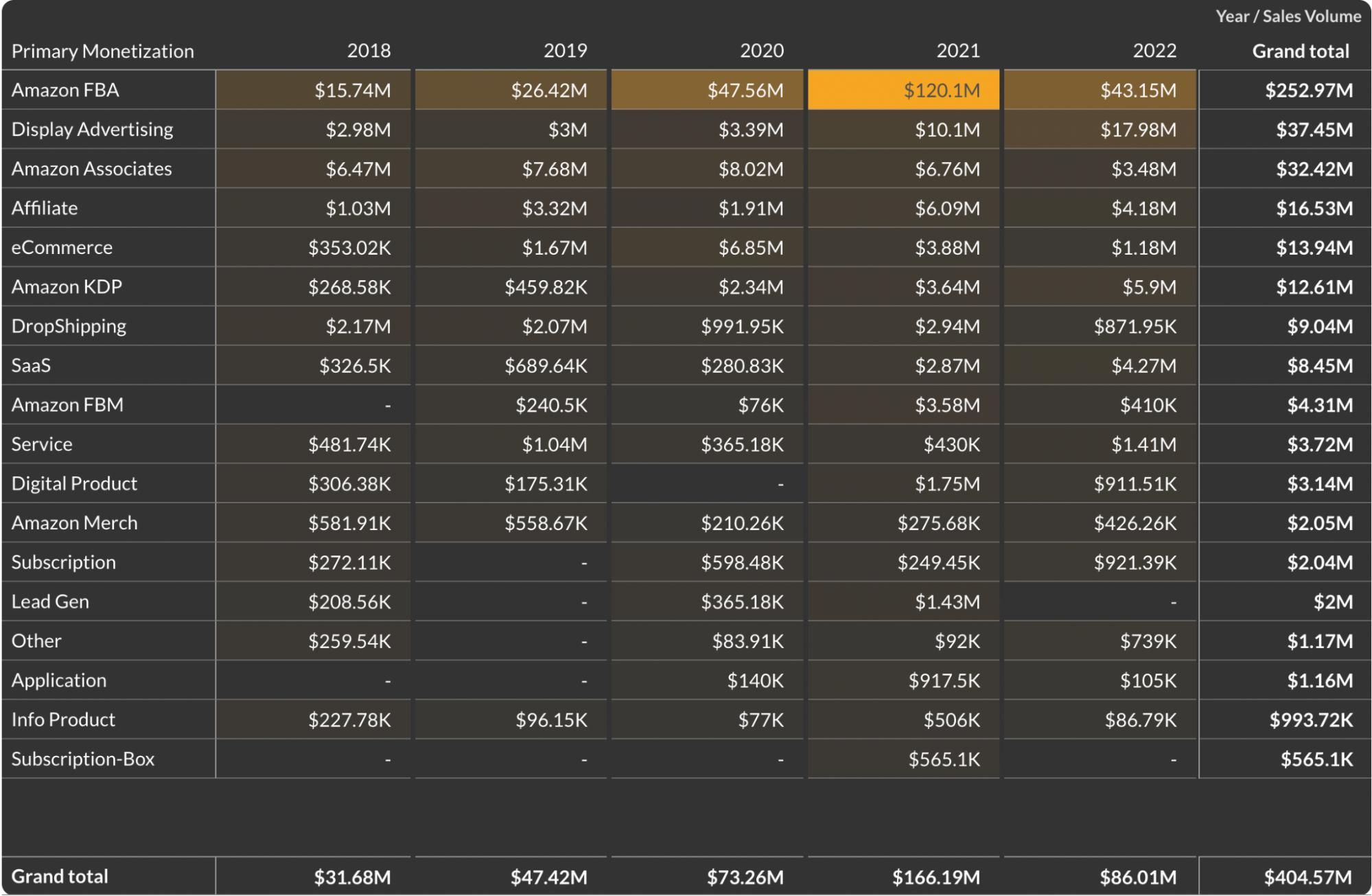

From 2021 to 2022, we saw a 48.25% decrease in total sales volume. However, when comparing 2019 to 2022, we saw an 81.38% increase in total sales volume.

This supports the previous data that demonstrates we’re normalizing but are still seeing growth in market appetite for online business acquisitions.

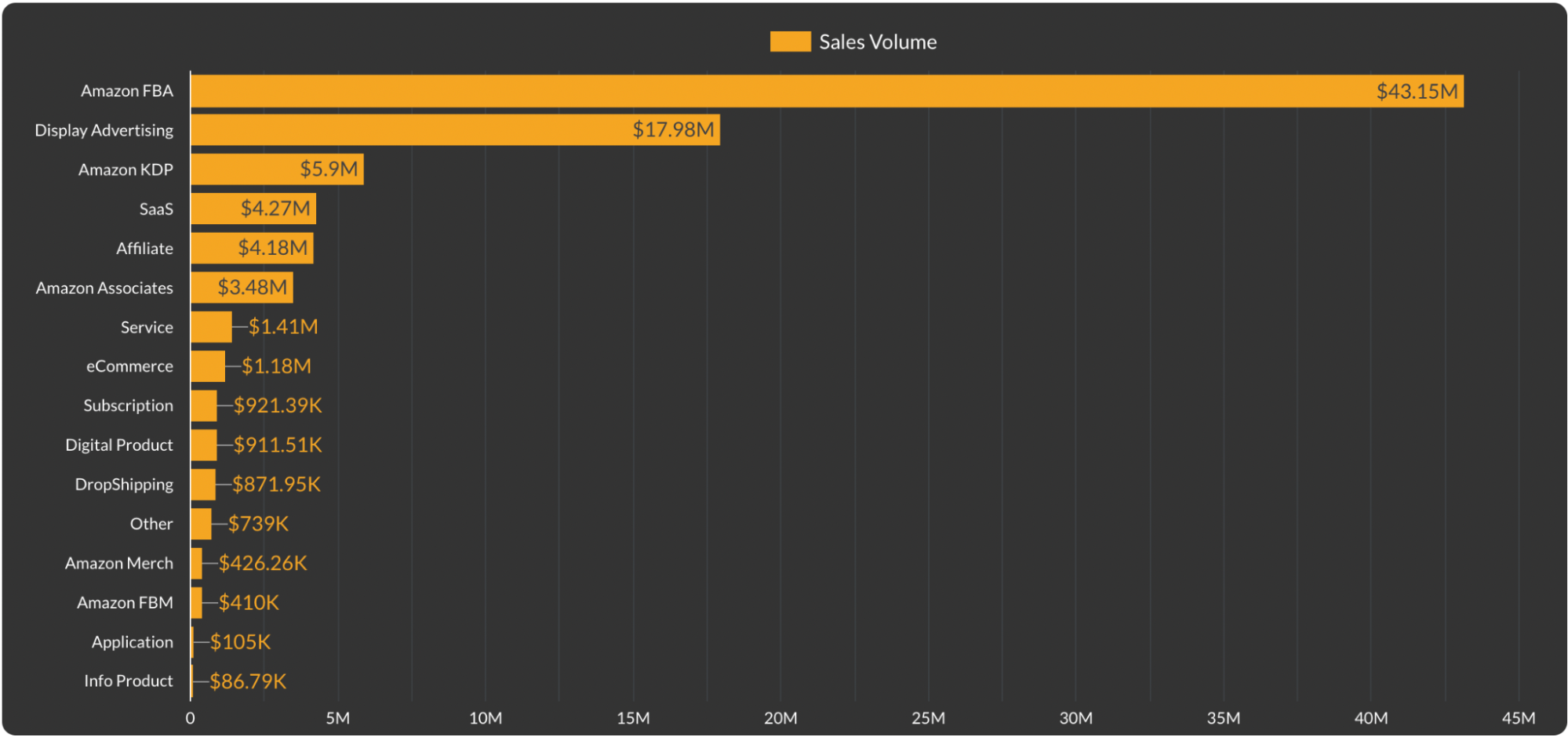

Of the $86.01M total sales volume in 2022:

- 50.17% was from Amazon FBA

- 20.90% was from Display Ads

- 6.86% was from Amazon KDP

- 4.96% was from SaaS

- 4.86% was from affiliate sites

- 4.05% was from Amazon Associates

- All remaining business models accounted for 8.2% of total sales volume

Despite Amazon FBA purchase volume decreasing from 2021-2022, this business model still accounted for over half of the sales generated in 2022. Amazon FBA businesses tend to be larger businesses with therefore higher valuations when compared to display advertising content sites and Amazon KDP businesses.

However, while contributing to a smaller percentage of sales volume, the next six highest-performing business models after Amazon FBA are either content sites, digital product businesses, and businesses that do not carry physical inventory.

Below shows how the sales volume for each business model has trended from 2018-2022:

eCommerce Businesses

Amazon FBA

From 2021 to 2022, we saw a 64.07% decrease in the total sales volume of Amazon FBA businesses. However, when comparing 2019 to 2022, we saw a 43.15% increase in total sales volume. This decline reflects the previously analyzed drop in $1M-$5M and $5M+ acquisitions. However, the market was still more comfortable buying larger Amazon FBA businesses in 2022 than it was in 2019.

eCommerce

From 2021 to 2022, we saw a 69.60% decrease in the total sales volume of eCommerce businesses. When comparing 2019 to 2022, we saw a 29.34% decrease in total sales volume.

Dropshipping

From 2021 to 2022, we saw a 70.34% decrease in the total sales volume of dropshipping businesses. When comparing 2019 to 2022, we saw a 57.9% decrease in total sales volume. The dropshipping business model seems to fluctuate in acquisition popularity year-over-year.

Content Sites

Display Advertising

From 2021 to 2022, we saw a 78.02% increase in the total sales volume of display advertising businesses. When comparing 2019 to 2022, we saw a 499.33% increase in total sales volume. These two data figures imply that, despite being temporarily overshadowed by the Amazon FBA business acquisition craze, display advertising content sites have continued to experience significant year-over-year growth in acquisition interest.

Amazon Associates

From 2021 to 2022, we saw a 48.52% decrease in total sales volume of Amazon Associates businesses. When comparing 2019 to 2022, we saw a 54.69% decrease in total sales volume. This decrease was expected, given the impact that the Amazon Associates’ commission slash had on business profits and buyer interest.

Affiliate Sites

From 2021 to 2022, we saw a 31.36% decrease in the total sales volume of affiliate businesses. When comparing 2019 to 2022, we saw a 25.90% increase in total sales volume.

Other Businesses

Amazon KDP

From 2021 to 2022, we saw a 62.09% increase in the total sales volume of Amazon KDP businesses. When comparing 2019 to 2022, we saw a 1183.11% increase in total sales volume. Amazon KDP represents the most dramatic spike in sales volume when comparing 2019 to 2022 figures. As of now, we’re unsure if this trend will continue to grow or if the Empire Flippers referral program brought in a surge of deals that created a temporary spike.

SaaS

From 2021 to 2022, we saw a 48.78% increase in the total sales volume of SaaS businesses. When comparing 2019 to 2022, we saw a 519.16% increase in total sales volume. SaaS represents the second-largest increase in sales volume when comparing 2019 to 2022. This trend will likely continue as more SaaS owners become aware of Empire Flippers as a solution for selling their SaaS business, and as SaaS ownership becomes a more viable option for buyers without strong technical skills with the growth of low-code and AI-assisted options for filling in technical gaps.

Overall, the biggest 2021-2022 increases came from display advertising-focused content sites, Amazon KDP, and SaaS businesses. The biggest decreases came from dropshipping, Amazon FBA, eCommerce, and Amazon Associates sites. One way of looking at this is business models with no physical inventory saw the biggest growth, while businesses that required physical inventory management or were directly connected with eCommerce businesses (Amazon Associates) saw the greatest decline.

Listing and Sales Valuation Multiple Trends

To determine how our buyer’s market values each business model, we tracked the average trailing-twelve-month listing and sale multiple for each of the major business models.

A listing multiple reflects the valuation of a business when first posted on the marketplace. A sales multiple reflects the valuation that the business was actually sold at after going through negotiations with the buyer.

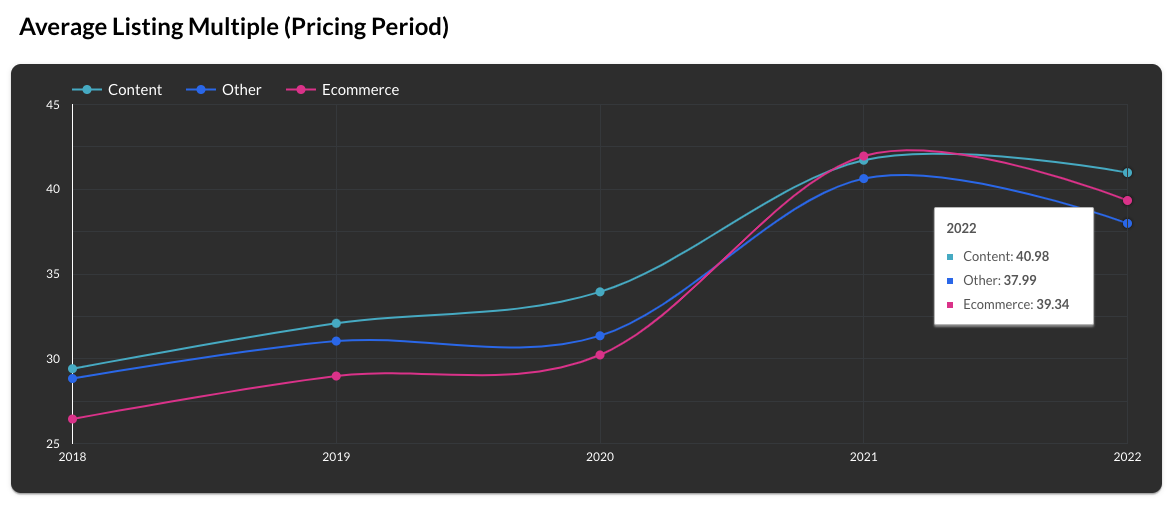

Below shows how the average listing multiple has trended for each major business model from 2018-2022:

In 2021, eCommerce businesses maintained the highest average listing multiple at 41.96x but experienced a sharp drop to 39.34x in 2022.

Content sites saw a similar average listing multiple of 41.71x in 2021, and saw a slight drop to 40.98x in 2022.

All other business models maintained a 40.63x average listing multiple in 2021 and dropped to 37.99x in 2022.

Multiples across all business models dropped in 2022, though content sites saw the lowest drop. The listing multiples for all business models are several points higher compared to 2019, which saw average listing multiples ranging from 28.98x-32.09x.

Below shows how the sale multiple has trended for each monetization category from 2018-2022:

In 2021, the average sale multiples for all business models ranged between 37.43x-37.84x. In 2022, content sites remained stable at 37.7x, while eCommerce businesses dropped to 34.35x and all other business models dropped to 33.19x.

The data illustrates that buyers were willing to purchase content sites for roughly the same valuation levels from 2021-2022. eCommerce businesses and all other business models, however, reached a peak in 2021.

That said, the current sales multiples for all business models are several points higher compared to each business model’s respective sales multiple during 2019.

Section 4: Industry Predictions for 2023 and Years to Come

eCommerce

For eCommerce businesses, we expect larger aggregators to continue selling off acquisitions to remain profitable and to cut losses. We believe this will create a less competitive market, making it easier for non-institutional buyers and mini aggregators to acquire Amazon FBA and eCommerce businesses.

However, the Amazon FBA business model will also likely increase in maturity and efficiency, meaning less opportunity for buyers to buy at low (undervalued) multiples and sellers to sell at high (overvalued) multiples.

Sellers and buyers will also need to see more eye-to-eye during negotiations, which includes being flexible on valuation multiples, deal structures, and conditions for getting the deal across.

Content Sites

We believe display advertising will continue to become a dominant monetization within content sites, for as long as it remains more profitable and easier to produce this type of content compared to Amazon Associates and other private affiliates.

Additionally, with information content being easier and less expensive to produce with generative AI tools, we believe content sites will continue to experience an upward trajectory and lead to more 7-figure exits for this business model.

Lastly, with the marketplace recently allowing sellers to sell foreign SEO sites, this will create additional supply and potentially new content site growth and portfolio-building strategies for buyers.

Other Businesses

We expect other “inventory-less” business models, such as Amazon KDP and SaaS, to continue to rise in acquisition popularity. Additionally, low-code technologies and AI tools are making these business models easier to build and grow, potentially leading to greater supply on the marketplace.

Today Has Become The Best Time to Sell

As with most investments, it’s impossible to predict the peaks until they pass. If 2021-2022 was historically the best time to sell an online business, today is the second best time to sell.

Regardless of how the market fluctuates our advice on when to sell remains the same: instead of timing the market, you should decide when to sell based on what would positively change your life.

Whether your goal for an exit is to retire, buy a house, spend more time with your family, or begin a new venture, your decision to exit should be a personal choice, not one that is necessarily dictated by the market. Rather, the question to ask yourself is whether your business can be sold at a level that helps you accomplish a life goal.

Based on this, if you determine that now is the right time for you to consider an exit or an acquisition, we can provide guidance with an exit planning call (for selling) or a criteria discovery call (for buying):

These calls are performed by our team of top-notch business advisers who are in the day-to-day trenches of buying and selling businesses.

Our audience has found these calls incredibly valuable, regardless of if they decided to sell or buy a business.

Click Here to Schedule a Criteria Discovery Call (for buying)

Click Here to Schedule an Exit Planning Call (for selling)

If you’d like to save this report as a PDF to read later or share with your peers, click the link below:

Download the Report as PDF