Our Q1 Business Report – January, February, March 2016

Welcome to our business report for Q1, 2016!

We have a ton of things to cover in this report, but thought I’d start it off saying that we’ve again had our best quarter ever, thanks to you.

Buyers and sellers on our platform completed 48 deals at just under $2M in value first three months of this year. Many sellers collected the necessary funds to take the next step in their entrepreneurial journey and many buyers were able to purchase their first online business or add to their growing portfolio.

You’ve chosen Empire Flippers as your preferred partner in buying/selling these websites and online businesses and we’re truly thankful for your continued support.

As always, our goal with these reports is to provide a high level of transparency in showing both our successes and failures with the hope that it helps you build your own online business. It also provides us with public accountability. We have a record of what we’re working on and can review, track our progress, etc.

We hope these reports encourage and inspire you as you continue to grow your online empire.

Executive Summary – Q1 2016

Here’s a look at month-by-month deals:

[wider_blog_insert img=”https://d1u4v6449fgzem.cloudfront.net/2016/05/EF-Marketplace-Month-By-Month-Q1-2016.png”][/wider_blog_insert]And our overall deals:

[wider_blog_insert img=”https://d1u4v6449fgzem.cloudfront.net/2016/05/EF-Marketplace-Overall-Q1-2016.png”][/wider_blog_insert]Q1 2016

Business Data:

- Total Team: 24

- Customer Heroes: 11

- Management: 5

- Apprentices: 2

- Contractors: 6

- Email Subscribers: 24,619

- Site Visits: 135,569 (Last Quarter: 116,575)

Revenue:

- Brokered Site Sales: $1,904,416.52 (Last Quarter: $1,106,162.84)

- Listing Fees: $16,202.00 (49 New, 17 Returning)

- Investor Program Raised: $0.00

- Investor Program Overall Earnings (Actual): $74,814.90 (Last Quarter: $36,567.77)

- Other: $1,085.80 (Last Quarter: $1,392.21)

Total Revenue: $1,996,519.22

Earnings:

- Brokered Site Earnings: $249,939.51 (Last Quarter: $141,943.05)

- Listing Fees: $16,202.00 (49 New, 16 Returning)

- Investor Program EF Earnings (Actual): $22,444.47 (Last Quarter: $10,970.33)

- Other: $1,085.80 (Last Quarter: $1,392.21)

Gross Earnings: $289,671.78 (Last Quarter: $165,974.16)

Revenue Breakdown

Now that we’ve looked at the totals, let’s break down each section to see exactly where the revenue came from.

Brokered Site Revenue

Overall, we brokered 48 deals totalling $1,904,416.52 in value. This brought in $249,939.51 for Empire Flippers. Our largest deal completed was $550K and our smallest was just over $3K, with our average for the quarter just under $40K.

This was a great start to the year and puts us well on our way to hitting the $7M sales goal for the year ($10M when you include the investor program).

Website Listing Fees

We brought in $16,202.00 from listings fees in Q1:

- 49 First Time listings @ $14,553.00

- 16 Repeat listings @ $1,552.00

This is a good indicator of the amount of listings we’ll have available in the coming months and we’re happy to see this continually improve.

Having potential sellers pay a fee upfront is just one of several hurdles in place to ensure we only receive quality listings from serious sellers.

We’d expect this number to go up throughout the year as we continue to grow our brand and carve out a larger piece of the industry.

Investor Program

In late 2015, we started a beta test of our “investor program” – a process where we select and manage a portfolio of websites from our marketplace on behalf of investors. This section will document that experiment publicly.

Investment Raised

We didn’t raise any money for the investor program in Q1, but did prepare for another raise we were looking to implement in Q2. As of April 2016, our investor programs is on hold as we make adjustments to get the program back on track. (See below)

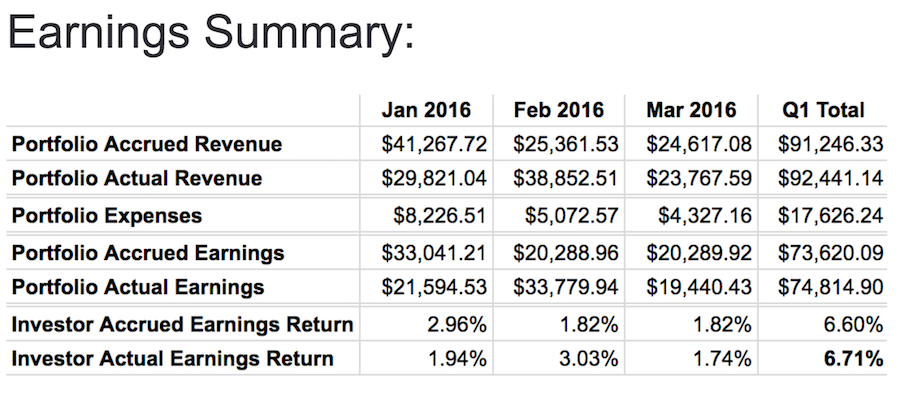

Quarterly Earnings

This was the first quarter where we were able to receive the full earnings from the portfolio.

Accrued Earnings For Q1, 2016: $91,246.33 – The reported amount from programs like Amazon, AdSense, etc. for the quarter.

Actual Earnings For Q1, 2016: $92,441.14 – The amount actually deposited into our bank account for the quarter.

The actual earnings were higher because we received the higher-than-normal payout from Amazon for Christmas, 2015.

Based on a 70% / 30% split on actual earnings, our investors received payments of $74,814.90 while the Empire Flippers share was $22,444.47.

While still not a major part of our earnings at Empire Flippers, the recurring profit from this beta test is attractive and helps to even out the up-and-down earnings from our marketplace.

Portfolio Update

We ran into some significant challenges at the end of Q1 that really set back our ability to move forward and raise funds for the next round. While not a complete disaster, these will likely take quite a bit of time/effort from us to correct, making it impossible to move forward on future rounds. Here are the issues with Portfolio One:

Issue #1: We had our AdWords account shut down.

While not a major blow to the portfolio overall, this significantly impacted the earnings from one of the larger sites in the portfolio. Our initial attempts to recover the account were unsuccessful, and we still don’t have a way to drive paid AdWords traffic to the site.

This issue alone wouldn’t have been that bad with the diversification in the portfolio, but combined with the other issues, it adds up.

Issue #2: A major affiliate dropped us from listing their product.

On one of our larger sites, a major affiliate dropped our ability to sell their product. It was a recurring product and they were reporting “low re-bills”, meaning not many of the customers we were sending were re-ordering. We were able to find another affiliates, but this definitely hurt conversions (and earnings) because it was our best converting product.

Issue #3: Our Amazon account was shut down, losing more than $30K.

At the end of the quarter, Amazon abruptly shut down our account, holding more than $30K in our account with no warning and no way to recover the funds. Our attempts to contact the Amazon support staff were fruitless and we’re left with no real way to correct the issue.

I’ll have more to say on this in an upcoming post, but this was the real bombshell that kept us from moving forward with the investor program.

What does this all mean? These three things combined account for approximately a 70% loss in income to the portfolio. While we didn’t feel that in Q1, it will likely have a very negative impact on Q2 and beyond, unless we find some way to fix these issues.

Until we’re able to get Portfolio 1 back on track, we just can’t move forward with another raise/round. We’ll likely have to put the program on hold for 4-6 months while we get the earnings back up to where they need to be to give our investors a return.

Additional Revenue

We brought in a total of $1,085.80 in additional revenue for Q1, mostly as affiliate income. This will remain a catch-all section to combine any smaller payments we receive outside the course of normal business.

Traffic And Audience

Here’s a detailed look at our site traffic, podcast downloads, and email subscribers Jan-Mar 2016.

Blog Traffic & Analytics

We had 135,569 visits in Q1, 2016:

This is up quite a bit from the previous quarter. Most of the traffic came from Google, direct, email, and Facebook.

I made some mistakes with our goals in Google Analytics for Q1, but should have that fixed for Q2 reporting.

Here are our top three pages on Empire Flippers:

Our top three listings:

- Listing #40396 – $1.2M AdSense/Amazon site package

- Listing #40388 – (Sold) $4K product site in the tech niche

- Listing #40405 – $2K AdSense site in the video game niche

And our top three pieces of content:

- Dropship Lifestyle – Podcast interview with Anton Kraly

- AdSense Account Disabled – What to do if (when?) your AdSense account is shut down

- Standard Operating Procedures – How we create SOP’s in our business

We’re expecting to put out quite a bit more with our latest hire (Content Manager) and have a much improved content schedule in place for the coming weeks/months.

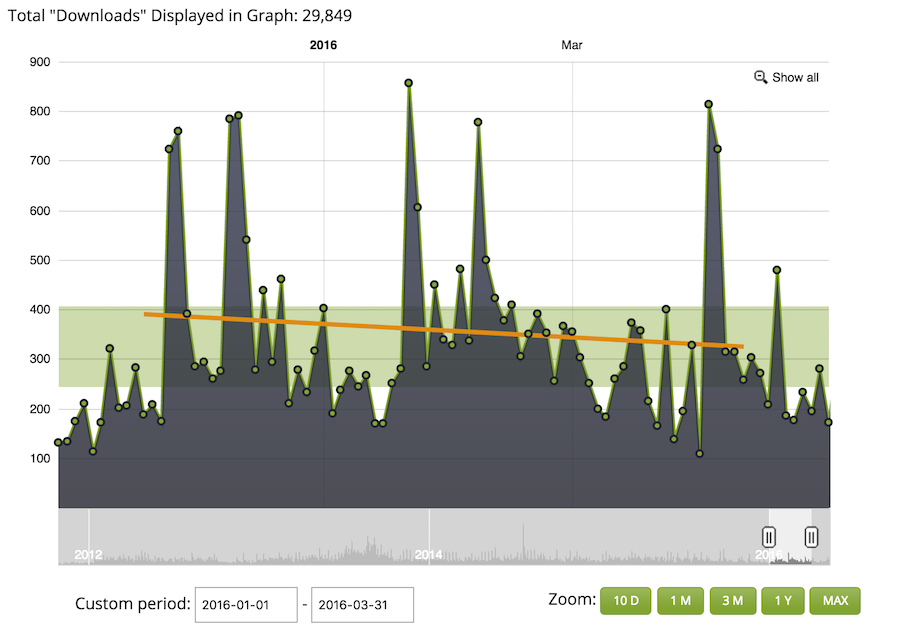

Podcast Downloads

We were back up a bit with podcast downloads for the Empire Flippers podcast, up to 29,849 for the quarter.

We had a total of 3,377 downloads of our second season of the Web Equity Show. As we’re about to wrap up this season, I’m looking to be a bit more consistent with the Empire Flippers podcast in the coming months.

Emails & Contacts

We ended Q1 with 24,619 email subscribers, up 1,578 over the previous quarter.

For the amount of traffic we’re gettting, our email subscribers are awfully low. My guess is that (during the redesign) our backing off the more promotional email optins on the site was a little too aggressive. Over the next couple of months, we plan to slowly get back to more optin boxes on the site, along with additional bribes and incentives for joining our email list.

Customer Experience

As we continue to broker more (and larger) deals, offering a positive customer experience remains a critical piece of the process. I’m happy to report that many of our buyers and sellers are repeat customers, but that doesn’t mean we don’t have room to improve.

We’re including some insights on customer experience to both hold ourselves accountable and to dig into the areas we could be better.

Zendesk Support

Here’s a look at our overall performance from Q1, 2016:

We’ve seen some slippage here, with our average response time jumping up to just over 13 hours. It’s not just the numbers, though. The top complaint we’re hearing from both buyers and sellers is that we’re not responding to tickets/requests fast enough.

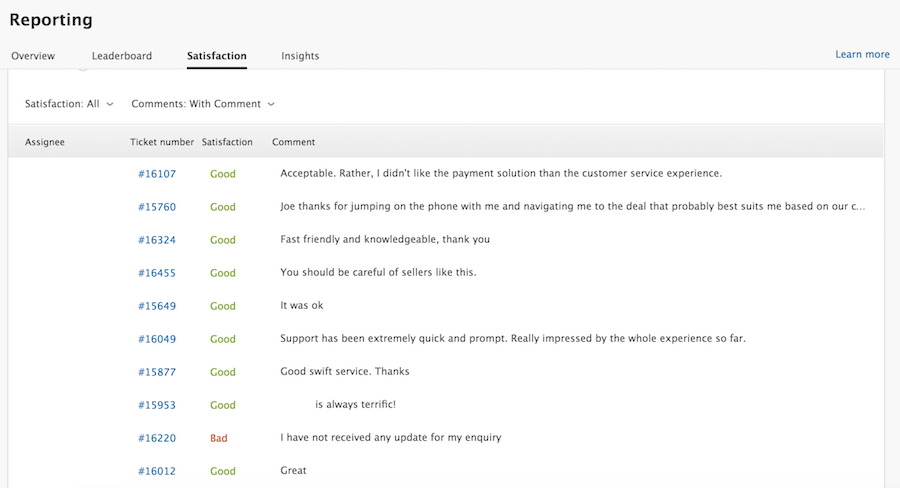

Customer Feedback

Out of 2,890 total tickets for the quarter, we received 278 good/satisfied responses and 20 bad/unsatisfied responses. Here’s a snapshot of what those comments looked like:

The feedback was generally positive. (Quick Note: A BIG thank you to Norms on our support team – so many customers singled her out by name for doing an EXCELLENT job!)

Some areas of improvement include faster response times and making sure we’re able to quickly relay offers and counter-offers.

What Happened In Q1 2016?

So what were we working on the past few months? Here are the highlights:

1. Hired A Content Manager (And A Sales-Marketing Coordinator)

Content marketing has been our #1 source for new customers for years. As we continue to grow, we want to expand our content marketing efforts beyond the industry and into new markets that might not be as familiar with buying/selling online businesses.

To do that, we need to expand our content marketing team. We received a few dozen qualified candidates from our recent job posting, and ended up hiring Greg Elfrink with a plan to have him join us in April. We had so many qualified candidates, in fact, that we ended up hiring Mike Swigunski for the role of Sales/Marketing Coordinator, where he’ll be responsible for tracking and helping to turn leads into sales.

2. Launched Season 2 Of The Web Equity Show

We wanted to do something different, so we decided to focus the entire season on buyers. We wanted to take an absolutely newbie all the way through the process, from learning how online businesses work all the way through negotiations and post-purchase growth strategies. If you’re at all interested in buying websites or online businesses, Season 2 of the Web Equity Show is a great resource for you.

That wraps up our Q1 2016 business report. Overall, we’re very happy with the trajectory of the brokerage, but have quite a bit of work in front of us to get the investor program back on track. We have the team and resources to make that happen, and are looking for another strong Q2/Q3 to help us hit our annual goals.

“New – Business Report for Q1 2016 from the @empireflippers!”

Now – over to you. What were you working on this last quarter? Any successes/failures you’d like to share? Let us know in the comments!

Discussion

Oh gowd… I lost both Adsense and Amazon account myself so I feel your pain. The worst thing in it all is that they just stay mute and don’t work with you after it happens. They are just too big to care. With $30k in the account I wonder how big must one be to get ahold of a rep.

This can always be fixed it just takes time to get there. It can very well happen the alternative will become better than what you had before.

And as far as the overall results… Congrats!

Yeah – I wonder how big you have to be for it to register over there as well.

$30K is pocket change to them and, frankly, it’s pretty small to the investor program overall. Hell, we’d forego getting the earnings back to have the accounts back (and earning again).

Thank you for the support!

Always appreciate the transparency you bring to your reports. I’m convinced that’s part of the reason your sales keep going up! I hope you’re able to get the answers you seek. I’d be tempted to get on a plane to Seattle and camp out till I got some answers!

Best to all of you and hope to see you in Vegas this fall,

Kae

Thanks, Kae.

It’s a mixed bag – excited about the brokerage, but disappointed with investor program. The brokerage is NOW, but we see the future in the investor program, so it’s frustrating to have these setbacks. Still…will probably take some time and stumbles before we get this figured out, I guess.

We just wish we could get real answers from the company. Argh.

Can you explain what happened with the Adwords account? I have heard of Amazon shutting down affiliate accounts (happened to me), but I haven’t heard of the Adwords scenario? Was it an issue with one of the sites?

It was the main paid traffic site in the portfolio, Christopher. Ultimately, it came down to the niche/industry not being acceptable. The reasoning we received was along the lines of “you can’t offer something that can be done for free”, but that didn’t make much sense to us. (i.e. Legal Zoom, SEO services, etc.)

Do you have any idea as to why you were shut down from Amazon at this point?

Hey John,

We’re still looking into it, but Amazon has been less than helpful here. I want to wait until I have the full story/picture and I’ll lay it out in more detail.

Sorry to be so coy, it’s just that this is still playing out and I need some answers/resolution before I can go into all the details.

How does that affect the investor program? I would assume that you must have violated the TOS in some way or Amazon wouldn’t have banned your account. If you are unable to recover the money still in the account is EF covering the loss?

Hey Tobias,

It’s pretty negative for the investor pool, frankly. I can’t speak to the TOS violation, but we’ve been looking into it and have struggled to find the issue. We’re doing everything we can to get these issues corrected and back on track and have been communicating that to the investors. We’re hopeful that will happen, although our initial attempts haven’t been very successful.

Hey Justin,

thanks for the reply. I hope you get your accounts back. I’ve heard a lot of horror stories of Amazon banning accounts for no apparent reason. If you’re displaying any prices on one of your sites that might be the reason. Hope it all turns out well. Keep us posted!

Looking forward to the future!

Same here, Greg! Funny to go back through previous reports. We’ve come a long way…

As always guys just love reading these posts, sounds like the marketplace is really continuing to get great traction! Also thanks for sharing what is going on with the investor program, surely this will build trust as you guys raise future rounds as well as making for some fascinating reading. Wish you luck in finding resolutions to the current challenges.

Thanks, Dan!

It’s odd to see our brokerage have the best quarter ever and yet we’re running into so many roadblocks with the investor program. We’ll keep the brokerage running and growing, of course, but we see real long-term value in the investor program that makes it worth spending the time/effort to figure it out and get it back on track.