Q1 Report: January, February, and March 2019

The first quarter of 2019 is already over!

That means it is time for us to share another quarterly report on our blog. In the last report, which was written during Q1, I talked about how we were on track to sell one business for every single business day of the week.

Well, I’m happy to announce that we kept up with that track record. Not only did we sell the most businesses than ever, but we also sold the most businesses ever from a pure revenue perspective.

In Q1 of 2019, we sold 79 businesses.

If you’d like to use our services to sell your business, then set up a free discovery call today. On that call, we’ll walk you through everything you need to know and should consider before you buy a business.

If you’re looking for a profitable exit, then you don’t want to miss setting up a time to chat with our exit planning specialist. We’re pretty excited about this new exit planning work we’ve been doing, and we’ll get into what it means later on in this report.

A big reason we do this report every quarter is because we believe in being transparent. In an industry full of shady backroom deals and limited information, we’re the honest ones. Initially, these reports were the personal income reports we used to keep score of how well we’re doing. Now, they show what is possible after committing to working hard, playing the long game, and sticking with the business through both ups and downs.

In the last three years, our company has grown from only 4–6 people to close to 60 people, as an example.

As much as we want to tell you about what is happening in our business, we hope this report still serves primarily to inspire you to climb to even greater heights.

Now, let’s dive into the numbers.

Executive Summary: Q1 of 2019 Report

Let’s look at our business data, revenue, and earnings, and then we’ll break each of these down further.

Q1 of 2019 Business Data

Business Data

Total team members: 56

Founders: 2

Sales team members: 14

Marketing team members: 5

Operations team members: 25

Engineering team members: 6

Human resources team members: 1

Contractors: 3

Email subscribers: 76,884

Podcast downloads: 28,315

Site visits: 297,435

Revenue

Brokered site sales: $9,764,786.91

Listing fees: $14,135.00

Additional/other revenue: $65.92

Average deal size: $125,189.58

Total revenue: $9,778,987.83

Earnings

Brokered site earnings: $1,304,154.79

Listing fees: $14,135.00

Additional revenue: $2.41

Total gross earnings: $1,318,292.20

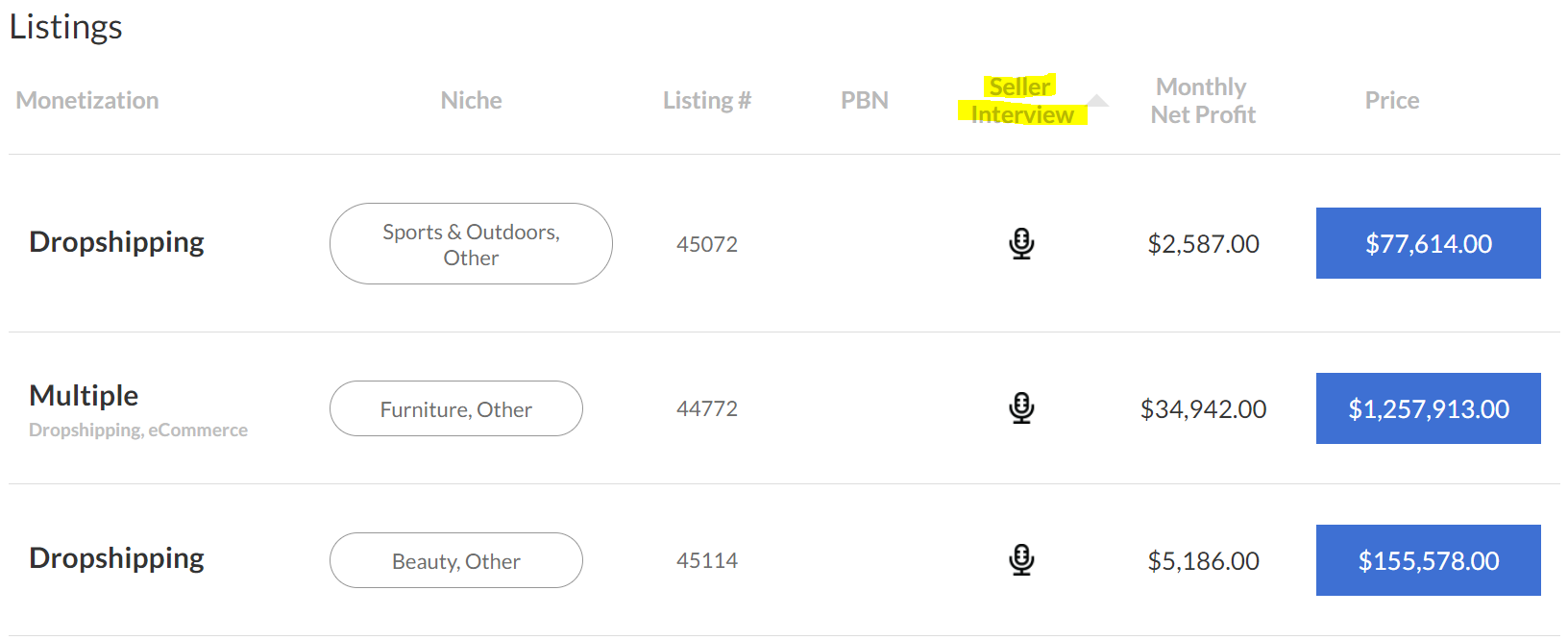

Our marketplace, team, and place in the industry continue to grow as we head deeper into 2019. On average, our marketplace has anywhere between 80–100 different businesses for sale. While we’ve always been the clear leader when it comes to deal flow, we’re also becoming the go-to for anyone looking to purchase 7-figure deals.

Seven 7-Figure Businesses for Sale

If you’re wondering what 7-figure deals we have for sale at the time of writing this article, they are as follows:

- Listing #45021 is an Amazon FBA and ecommerce business in the sports niche and was created in March of 2015. Their Seller Central account boasts 363 SKUs, which make up 60% of their revenue. This business is valued at $3,016,271.

- Listing #45470 is an Amazon FBA and ecommerce business operating in several different niches. The business has two Seller Central accounts and features 200 SKUS between the two. This business is valued at $2,299,143.

- Listing #44985 is an Amazon FBA and wholesale business in the electronics niche and was created in August of 2014. This business features 55 SKUs, with 85% of the revenue coming from the Vendor Central side of the business and the remainder coming from a Shopify store. This business is valued at $2,130,703.

- Listing #45430 is a package of Amazon FBM and Amazon FBA, operating in multiple niches, and was created in August of 2014. The FBA portion of the business features 113 SKUs, has a trademark, and is part of Brand Registry 2.0. This business is valued at $1,922,091.

- Listing #46056 is an Amazon FBA, FBM, and ecommerce business created in March of 2018; it operates in the personal care niche. The Amazon business features 4 SKUs that help customers sleep better. This business is valued at $1,794,793.

- Listing #45966 is an Amazon FBA and ecommerce business created in May of 2015 that operates in the apparel and accessories niche. This business sells on several other platforms outside of Amazon and has an employee that does the majority of the day-to-day work. This business is valued at $1,692,886.

- Listing #44647 is an Amazon FBA business created in January of 2017 that operates in the mobile accessories niche. The business boasts 170 SKUs, all with highly reviewed listings on Amazon. The business is valued at $1,461,244.

We’ve become more and more comfortable with selling larger deals. It’s not unreasonable for us to sell $10M+ listings over the next couple of years with the buyers that have been contacting us. We haven’t seen a business of that size head into vetting yet, but we’re pretty sure we’ve got buyers who would be interested.

In some ways, it becomes easier to sell a business once it worth over $10 million. Once you get to a certain size, traditional financing options open up; as such, formulating a deal that makes the buyer and seller happy is easy in many cases. The $1–5 million range requires more skill and creativity to secure deals.

While it wasn’t easy at first, the $1–5-million range is finally becoming easier for us!

Revenue Breakdown

Looking at the hard business data above is interesting, but it doesn’t paint our story. Let’s break down the business into both the revenue we earned and the actual earnings we got to keep from that revenue.

Brokered Site Revenue

In Q1 of 2019, we sold 78 deals, which is the most deals we’ve ever done in a single quarter since we started tracking it back in 2015. This is a huge sign that we continue to head in the right direction.

Those 78 deals translate into $9,764,786.91 in revenue, which is also the largest amount of revenue we’ve ever done in a single quarter, with the second-largest quarter being Q2 of 2018 at $9,285,120.16.

Keep in mind that, while we collected $9,787,786.91 in revenue, our actual gross earnings were $1,304,154.79 for the quarter; it is still the largest earning quarter we’ve ever had.

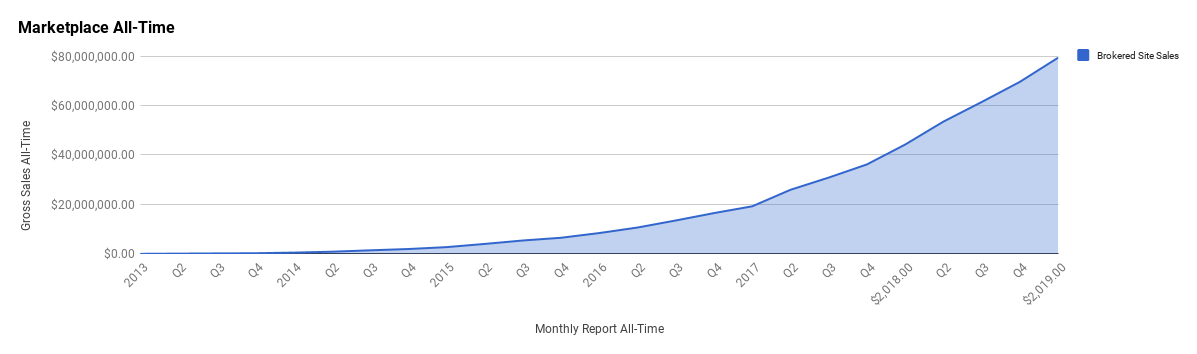

Below is a look at our marketplace quarter to quarter.

You can the slumps pretty clearly in this quarterly chart. While the slumps always feel bad when they happen, it is important to look at the entire trend and not get too focused on a single month or quarter.

As you can see above, some of our recent slumps actually brought in more revenue then we could’ve ever dreamed possible just a few short years ago. If you’re in a slump, it might be worthwhile to check out your businesses’ trend line to help you not focus on just a narrow slit of time.

Our Q4 report mentioned this slump, but, as you can see, Q1 has reversed that trend in a pretty significant way for us. While Q2 is still pretty early, it seems that Q2 will continue that trend for now.

If you really want to see our growth trend, check out our brokered site sales graph below.

We have healthy growth trends in all the right directions; alas, including a slight growth in our average deal size. In Q4 of 2018, our average deal size was $123,686.69, while, in Q1 of 2019, it was $125,189.58. Our best quarter ever in terms of average deal size was in Q2 of 2018 at $128,765.84, which is only slightly higher than that in the last two quarters.

Keep in that our average deal size becomes heavily skewed because of the sheer volume we sell in the sub $200k range. It is not uncommon to have 30-40 new businesses submitted to us every single week. For some people they might see this average deal size and think we don’t sell the bigger deals, but that is simply not true.

While our average was $125,189.58, that doesn’t represent all the money we took in for the quarter either. Rather, that represents the money we earned from the 78 businesses we sold for the quarter. In Q1 2019 we also saw the benefit of having many different earn-out payments coming in every single month. While not huge compared to the 78 businesses we sold, it was an extra $144,657.66 for the quarter. The extra money is equivalent to an extra business being sold on our marketplace without no real effort on our part other than managing the earn out.

If you’re unfamiliar with earn-outs, you can learn more about this buying tool in our definitive guide to deal structuring. As of this writing, we are the only broker that actively manages the earn out for both the buyer and the seller until the earn out is completed. One of the many benefits that just make us a bit different than the other options out there.

Overall, this is a great sign of us trending up in terms of average deal size.

Below is a breakdown of our average deal size quarter by quarter.

One more thing to point out about our average deal size is that the number is skewed. We sell anywhere between $20,000 content sites all the way up to multimillion-dollar ecommerce businesses. This means our average deal size is heavily skewed toward a lower price point because of the sheer amount of deals we sell.

Business Listing Fees

In order to sell your business with us for the first time, you’ll usually need to pay a listing fee. The fee for a first-time seller is $297; it is $97 for returning sellers. For sellers that have been vetted by our business analysts through an exit planning call, we can often waive the listing fee.

The listing fee isn’t really meant to be a profit producer for us but rather a small barrier to entry that removes 99% of sellers that aren’t really serious about selling their businesses with us. Still, in Q1 of 2019, we made $14,135 in listing fees from 44 first-time sellers and 11 returning sellers. Hitting $14,135 makes Q1 of 2019 one of the top quarters we’ve ever done in terms of listing fees. Though these fees don’t move the needle for us at all, it is still cool to see that our brand has built a level of trust with sellers.

In addition to this being one of the higher quarters for listing fees, Q1 of 2019 was our largest quarter ever when it comes to overall seller submissions. We averaged 27 seller submissions per week, with our best week of the quarter netting us 45 more submissions from entrepreneurs wanting to make profitable exits.

Traffic and Audience

Blog Traffic and Analytics

Our blog is one of our primary traffic generators. Long before we had a marketplace selling businesses, we had a blog talking about building out niche sites. As time has gone on, our blog has served as the focal point for sharing life-changing stories, 7-figure case studies, and updates about the company, and it has been a major traffic generator through SEO and referral traffic.

Below is a look at our traffic during Q1 of 2019.

We had 297,435 sessions in Q1 of 2019, which is slightly down from Q4 of 2018. We had 311,257 sessions in Q4 of 2018, so we dropped slightly during this quarter. A better comparison between quarters would be comparing Q1 of 2019’s traffic with Q1 of 2018’s traffic.

In Q1 of 2018, we had 244,464 total sessions, meaning we had 52,971 more sessions in 2019. The growth in traffic is in alignment with our general steady trend upward when it comes to our SEO efforts.

Below is a breakdown of our various traffic channels in Q1 of 2019.

As you can see, organic search is by far our biggest winner for traffic at 100,602 users for the quarter. In future quarters, we expect this to grow even more as we put more focus on content creation and optimization in 2019 and 2020.

The second-largest channel is direct, which is reflective of our brand growth. Every conference we do, every speech we give, and every event we hold grows this direct traffic metric as more people hear about us and begin to use our services.

We can break this traffic down into a few different categories to see what our traffic is actually gravitating toward.

Here are our top three most viewed pages:

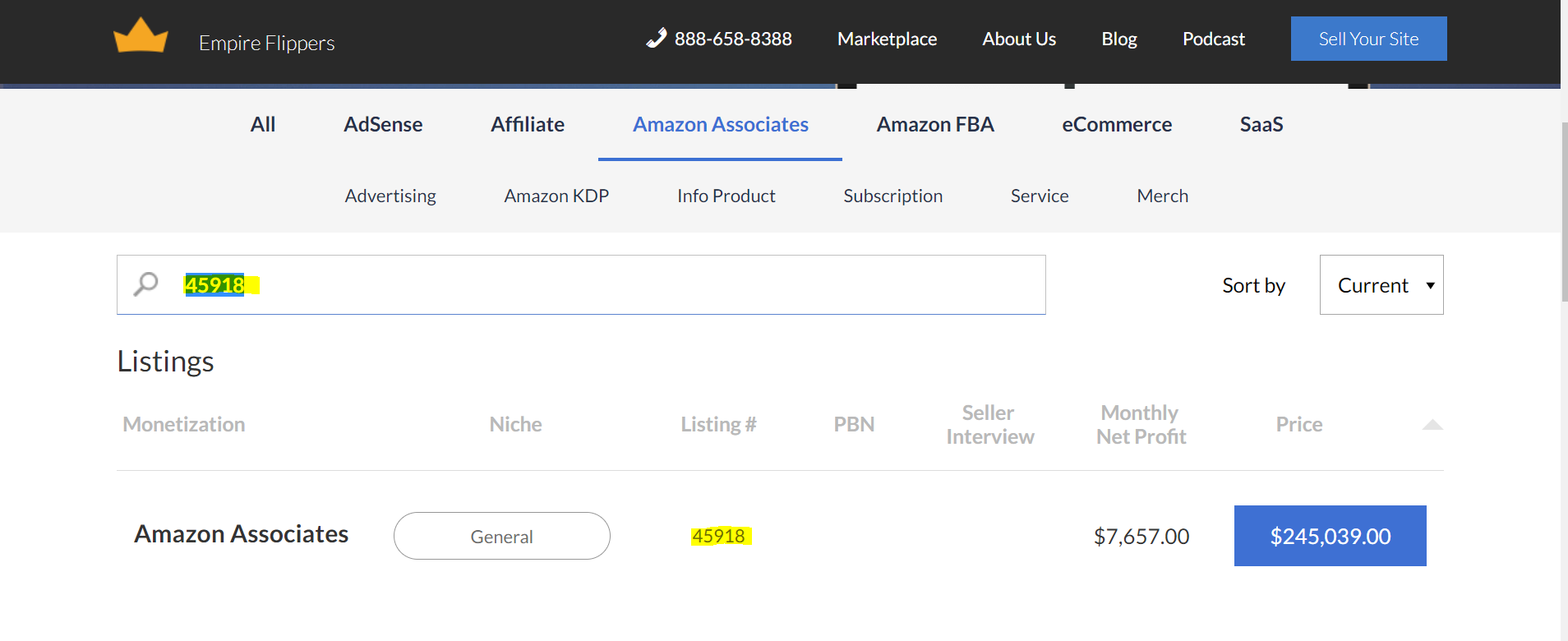

Here are our top three most viewed listings:

- Listing #44987 is an affiliate business that was created in June of 2017; it operates in the information niche, using custom-built features to deliver coupons to visitors. This business is valued at $1,609,943 with a 31x multiple.

- Listing #45021 is an Amazon FBA and ecommerce business that was created in March of 2015 and that operates in the sports niche. The Seller Central account boasts 363 SKUs, which bring in around 60% of the revenue. This business is valued at $3,016,271 with a 34x multiple.

- Listing #45578 is a 4-site AdSense site package that was created in September of 2017 and that operates in the technology niche. The business has year-on-year growth and takes minimal work from the seller to maintain. This business is valued at $38,608 with a 27x multiple.

Here are our top three most viewed pieces of content:

- The 11 Most Popular Online Business Models

- Top 10 Affiliate Networks and Programs That Aren’t Amazon in 2019

- Buying & Selling Amazon FBA Businesses: What Our $3,650,106.28 Case Study Found Out in 2017

Here are our top three most recently viewed pieces of content:

- [CASE STUDY] How We Sold a $93,077.32 Merch by Amazon Business in 19 Days

- How to Start a SaaS Company with Only a Few Hundred Bucks

- How to Make Money on Youtube Without Hundreds of Thousands of Views

Podcasts and Shows

We are huge fans of the podcast medium. It is one of the best types of media to communicate long-form and engaging content with audiences. While they might not be the best lead producer, podcasts remain one of the best nurturing arms in our marketing arsenal. They allow people that may have read a blog, spoke to a business analyst, or met us at a conference to get to know us on a deeper level and on their time.

It is not uncommon that people feel like they know who we are because they’ve been listening to our voices for several weeks, months, or even years on end. This kind of marketing channel has been invaluable to us when it comes to really cementing the trust we have with our audience and customers.

Since our initial Empire Flippers podcast, we launched two more podcasts: The Web Equity Show and The Real Money Real Business Show. We are looking to eventually expand even further with another show down the road.

In Q1 of 2019, we had 28,315 downloads of our podcasts.

Let’s break down each show.

Empire Flippers

The Empire Flippers podcast is our flagship podcast and was our first show. Justin and Joe share their business wisdom or interview other successful digital entrepreneurs that have interesting stories to share.

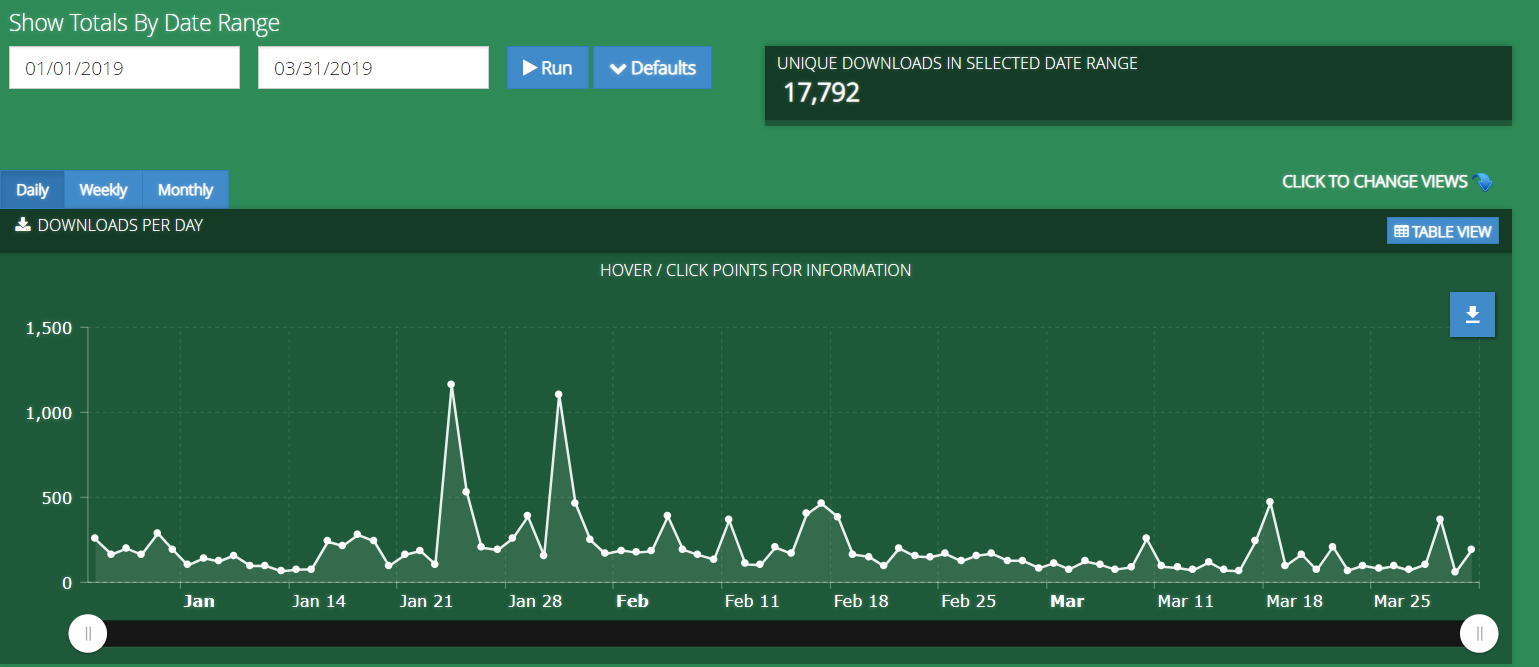

Despite this podcast being off and on again in terms of its publishing schedule, its popularity remains clear with 17,792 podcast downloads in Q1. If you haven’t ever listened to the podcast, you can hear the latest episode where we talk SEO with Matt Diggity here.

You can see our downloads below.

The Web Equity Show

The Web Equity Show is the brainchild of Justin Cooke and Ace Chapman in partnership. The concept is to release an entire season of a podcast; each season is focused on a specific part of the buying or selling process.

No other podcast has tackled this content as well as The Web Equity Show, and none of them lay it out so clearly. If you’re just getting started in the space of buying and selling online businesses, then starting at Season 1 Episode 1 will give you a great breakdown of the entire industry. You can listen to that first episode here.

Each season progresses in its knowledge and complexity, with our latest season being about raising capital and funding 7-figure digital deals.

In Q1 of 2019, we had 6,597 downloads.

If you want to become a master deal maker, there’s no better place to start than listening to The Web Equity Show and then scheduling a buyer criteria call with our analysts.

Real Money Real Business

The Real Money Real Business Show is where we interview real online entrepreneurs who are selling their businesses. The idea came initially from our work doing seller interviews on our YouTube channel.

For every business selling on our marketplace that is worth $45,000 or more, we interview a seller. Our listing copywriter schedules the podcast-style interviews. These interviews are incredibly valuable to both buyers and sellers. They allow buyers to get to know, like, and trust sellers without actually having to commit to anything. Often, this will lead to a better negotiating environment and better deals for sellers.

We had people asking us to upload these interviews in podcast format as well, so we decided to take our best seller interviews and publish them as a standalone show. While this has taken time and we’re still working on it to make it better, we’ve gotten positive feedback on the overall experience.

The new podcast channel allows us to broadcast more content and add more value, all while helping our customers market their businesses better.

In Q1 of 2019, we had 3,926 downloads, as shown in the chart below.

The lesson to take away from this podcast is that you probably have pieces of content that are only on one channel that can be used on others. Content repurposing is one of the fastest ways to scale your content marketing; since the content has already been created, all that is needed is to adapt it to a new format.

In 2019 and 2020, we’re going to be working on solutions to do more content repurposing. The one thing you have to make sure of when content repurposing, though, is to make sure the content has truly been adapted to its new medium.

Even though our seller interviews on YouTube were similar to a podcast, we still found some stumbling blocks when first launching the show since it didn’t fit perfectly into the podcast mold, at first.

You might have a similar experience, but stick with it, as content repurposing can lead to an extra bump in traffic.

Email and Contacts

Perhaps even more so than our blog or podcast, email marketing remains one of our strongest marketing channels. It is also one of our most valuable assets, as the audience is truly addressable.

Addressable audiences provide their email addresses, phone numbers, or physical mailing addresses to hear more from you. In many ways, an addressable audience is the most valuable asset a business can hope to grow and maintain.

Right now, our email list has 76,898 active subscribers, but our total contacts are sitting at 114,109. When it comes to marketing messages, it is the active subscribers we’re sending out to; when it comes to actually doing business, we are using all 114,109 contacts in our CRM to help get deals done.

Our email growth has never been meteoric. It is similar to our organic traffic growth, and it is consistently growing week in and week out, as shown below.

As you can see, the line is barely moving up. When you look at our email growth over time, though, you can see that this steady growth has accumulated into a powerful email list.

Below shows our contact growth over time.

We just completed the first part of our new email marketing makeover. Soon, we’ll have email marketing funnels set up for specific monetizations on both the buyer and seller sides, providing relevant content to them based on where they are in our funnels.

We’re pretty excited about it.

If you want to be the first to experience the new funnels once they’re actually live, click here to share your buying interests, or click here to share your selling interests.

Customer Experience

Zendesk Support

Zendesk remains our workhorse software when it comes to communicating with clients. While Zendesk isn’t really meant to be used the way we use it, we’ve been able to make it work for years at this point; there is no sign of us switching from it.

We had considered creating our own communication solution but realized that task was a magnitude too complex for us to undertake in an economical way. For now, Zendesk will remain a permanent part of how we do business.

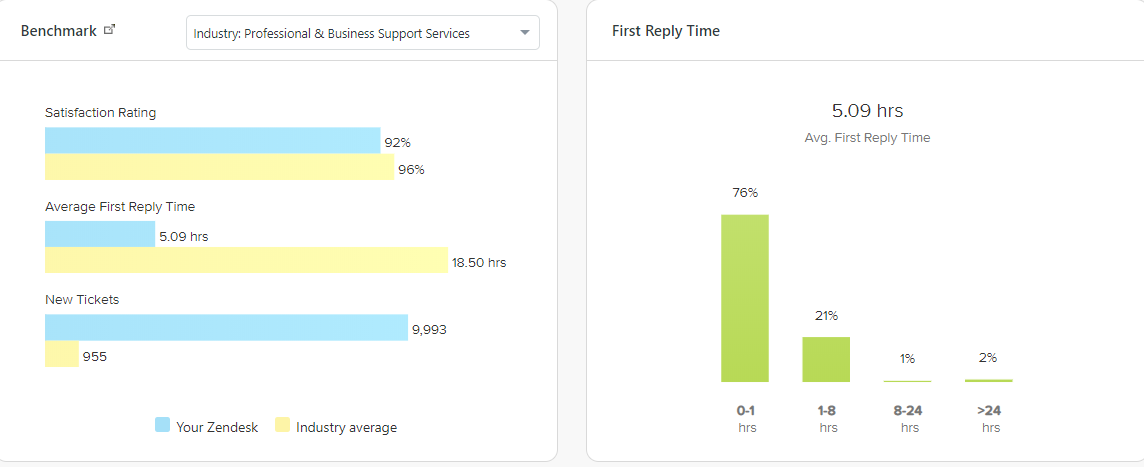

Despite the negative aspects of Zendesk, overall, we’re still doing pretty well using it, as you can see below.

The vast majority of inquiries are answered within the first hour (76%), which is pretty mind boggling considering we have thousands of new tickets opening up throughout the quarter.

We have noticed that, sometimes, it is better to communicate with our clients outside of the Zendesk platform and have started doing this more. We’re also working on a way to white label Zendesk into the new platform we’re working on to make it an overall better user experience for our customers.

Customer Feedback

So, how did we actually do in Q1 according to our customers? Well, as it turns out, pretty good.

Take a look at our customer satisfaction score.

Below is some of our customers’ feedback for us, both positive and negative.

What Happened in Q1 of 2019?

A lot went down during Q1 of 2019, not just conferences.

Let’s explore some notable events!

The Nomad Summit

We attended the Nomad Summit this year, with our senior business advisor, Mike Pregulman, giving a speech to the audience. The Nomad Summit is a great event if you’re just looking to get started in the digital nomad and online business space. There is a lot of inspirational content there that can show you what is possible. In addition, there is the opportunity to make a lot of great connections at this yearly event in Chiang Mai, Thailand.

Marketing Qualified Leads as Revenue

One of the big changes to our marketing this year was switching our goals from being project based to number based. We created an MQL as Revenue model to give the marketing team a number to hit every quarter.

How it works is we look at what we define as an MQL, that is, a lead that has engaged with our marketing content and is getting close to being talked to by sales, and then we look at how many MQLs were required to hit our revenue goals last quarter. Dividing the revenue by the number of MQLs results in the worth of a single MQL in terms of revenue.

Now, we did not create this model using the best data, considering we implemented the MQL as Revenue model at the end of Q4 using only half of that quarter’s data and using some shaky definitions of what an MQL means for us.

Surprisingly, our initial predictions for what an MQL is worth to us was pretty spot on by the end of Q1. When we created the first model at the start of Q1, we predicted that a single MQL is worth $4,416.91 of revenue.

We just recalculated the numbers at the end of Q1 and saw that the true MQL as revenue number is $4,332.47.

This number will be recalculated every quarter to give us a better model, but we’re still pretty proud about how close we were using the data we were working with.

Ultimately, this data will allow us to keep marketing while remaining flexible and focused at the same time. Our main goal in marketing is always to grow MQLs more effectively and at scale. While this is our main goal, we can remain flexible in terms of what we actually do to achieve that goal. For example, if we put a project down as a quarterly goal, we’re not stuck to completing that project if we find a better way to hit those MQLs throughout the quarter.

It is also nice that, since MQLs are tied to revenue, marketing and sales have become much more aligned since we began implementing this model.

Smarketing Meetings

Another thing we did to help align marketing and sales was implementing smarketing meetings. This was a direct result of watching HubSpot Academy. The theory is that, as your company grows bigger, sales and marketing become more misaligned.

We saw this begin to happen as we scaled, and, in order to prevent it from increasing, we now hold two smarketing meetings per month. This is where parts of the marketing and sales teams get together to discuss various pain points we’re having and the challenges we’re facing and to come up with solutions together. It also keeps the sales team aware of what marketing can and cannot do, and it keeps the marketing team up to date with what sales are being seen in the marketplace. This helps us remain on top of any emerging trends that might be opportunities for us to explore.

Overall, these meetings have been a great way to facilitate open and honest conversations between the two departments and to make both departments feel like they’re being heard.

Birth of a Platform

In Q1, we launched the internal alpha of a platform we’re working on. Eventually, this platform will be customer facing. The first few weeks of the platform being live was rough, but we were able to fix countless bugs and make the UI even better for the launch.

The platform is the first of its kind in our industry, and we think it is going to be a huge game changer. I can’t speak too much about what is coming, but I can say it is going to make buying and selling online businesses (plus a bunch of other cool stuff) a whole lot easier for you.

I’ll leave this on a bit of a cliffhanger, but . . . you’re going to be very excited once this rolls out in full swing!

One Deal a Day

While this is not exactly an event we went to, it is a cool thing to highlight.

For every business day of the quarter, we sold at least one business. Our sales team has been rallying behind the #dealaday hashtag ever since, and, in Q2, it looks like we’re on track to doing a #dealaday for this quarter.

As far as we’re aware, no other broker does this many deals, and, to be quite honest, they can’t because they simply don’t have the deal flow to pull it off.

Introducing the Seller Pod and the Most Seller Submissions Ever

In Q1, we rolled out what we’re calling the Seller Pod in our sales team. The Seller Pod is 100% focused and dedicated to answering sellers who have questions before listing their businesses for sale. The Seller Pod right now is led by Andrew Voda, a senior business analyst, and Jim Barton, who joined the team recently.

We’ve already seen huge benefits from the Seller Pod. In Q1, we had our most seller submissions ever at 27 new businesses per week. It is also because of the Seller Pod that we had our most seller submissions ever in a single week at 45 submissions.

As our company continues to grow and businesses looking to sell become more complex, it is no longer simply marketing tactics that can get entrepreneurs to submit their businesses.

Now, it is more of a tag-team approach. Marketing helps nurture trust and build awareness; our Seller Pod takes it from there, deepening relationships with entrepreneurs to ultimately get them to sell with us.

Letting the Dust Settle

At the end of Q4 of 2018, we were alarmed at the slump in revenue we were seeing. After all, we just had a huge hiring growth spurt. When we got together to plan out 2019 for the year, we decided that 2019 would be a reset year for us.

If you scale your company quickly, you’re going to run into many different inefficiencies that crop up. There are processes that work great when you’re a small team, but you may find out quickly that, at scale, they just do not work in the same way (or, at least, not as well as you thought they would!).

That is why, in 2019, we decided to have a hiring freeze (except to replace people we lose throughout the year) and really buckle down on increasing efficiencies using technology and by revamping old processes.

While we do plan to grow in 2019, it won’t likely be 2X – 3X growth as in previous years. It is merely the calm before the storm the way we see it. Focusing on our processes, technologies, and people this year will put us in an amazing position to continue a higher growth trajectory again in 2020.

That Wraps Up Q1 of 2018 (and the Year)!

That sums up everything that happened in Q1 of 2019, and we’re pretty excited with how our Q2 is shaping up already.

How was your Q1? Did you reach new heights? Did you overcome new challenges? Or is business just running smoothly for you?

Whatever is happening with your business, we hope you found this report inspiring to help fuel your next stage of growth!

Remember, whether you’re wanting to sell your business for a six-figure exit or acquire your next profit producing asset, we’re here for you all the way.

Discussion

Great work guys!