Our Q2 2017 Business Report – April, May, and June 2017

We’re already halfway through 2017!

This year has been flying by, and we have grown significantly since we last updated you. We added new employees, had our biggest quarter ever, and closed a $1.7 million deal.

And now it’s time for another quarterly report.

We have a lot to cover and we hope this report not only shows you how we are doing, but ultimately inspires YOU to reach even greater heights with your own business.

There is no way we could have done what we did last quarter if it weren’t for the support of our customers. People keep choosing us as their preferred partner when it comes to buying, investing, and selling online businesses — and for that we are thankful.

Now, let’s do a deep dive into our numbers for the quarter.

Executive Summary – Q2 2017 Report

As I mentioned, last quarter was a HUGE growth period for us … not just operationally, either, as you can tell by the graphs below.

Here’s a look at our deals for the quarter:

Here’s a look at our marketplace over all time:

Q2 2017

Business Data:

- Total Team: 25

- CS Agents: 9

- Management: 4

- Business Advisors: 4

- Apprentices: 4

- Contractors: 4

- Email Subscribers: 37,981

- Podcast Downloads: 36,255

- Site Visits: 259,170

Revenue:

- Brokered Site Sales: $6,676,009.72

- Listing Fees: $14,438.00

- Investor Program Raised: $0.00

- Investor Program Overall Earnings: $3,359.63

- Average Deal Size: $115,103.62

Total Revenue: $6,693,934.96

Earnings:

- Brokered Site Earnings: $669,903.19

- Listing Fees: $14,438.00

- Investor Program EF Earnings: $1,007.89

- Additional Revenue: $127.61

Total Gross Earnings: $685,476.69

Revenue Breakdown

That is a lot of numbers, and if you’re comparing this report to last quarter’s report, you’ve probably spotted the pretty huge leap in growth.

Let’s break down the numbers in their own section and talk about what happened during Q2 2017.

Brokered Site Revenue

We brokered 58 deals in Q2 for $6,676,009.72.

That puts our total all-time revenue at $25,914,699.92.

This was a huge increase for us. In one quarter, we effectively made 26 percent (25.7 percent to be precise) of the entire revenue of the company since it has existed. Unlike Q1, we met our earnings goals in Q2, and sold the biggest listing ever at $1.7 million.

Our investment in creating a salesforce has paid off dramatically, and has allowed us to communicate with more of our clients at once, advising them on their best options when it comes to buying, selling, and investing in online businesses. The sales team has been able to wrangle our overflowing leads down to a manageable level, and they’ve been able to add that extra touch of care we were missing before. While creating our sales team was a big deal, another huge component that helped us last quarter was doing a major overhaul of our operations.

Last quarter, we invested heavily in our customer services operations by bringing on three apprentices to be our customer advisors. The work these advisors did led to the implementation of a myriad of updated systems, including our vetting, customer service, and migrations departments. The changes have allowed us to streamline a lot of our processes.

These new systems have cut down on miscommunications, both internally and externally. Overall, the systems are keeping our customers much happier, which is another part of what made Q2 so successful for us.

All of these investments in staff, along with continued marketing, have led to our deal sizes increasing by a solid leap:

Last quarter, our average deal size was $59,688.21. This quarter, our average deal size was $115,103.62 — nearly double what it was just the previous quarter!

While these are huge numbers in terms of revenue, it is important to remember we take home only a small percentage through our 15 percent commission. That means in Q2, we actually brought into the business $669,903.19 in deal fees.

Website Listing Fees

The listing fees are still doing a wonderful job of covering the costs of vetting new businesses coming onto our marketplace and acting as a good filter for serious sellers. The majority of people who pay the $297 down to sell their business tend to be much more serious than if we allowed just anyone to submit their site for sale.

We have two tiers of listing fees:

- First-time sellers pay a $297 listing fee to go live on our marketplace

- Returning sellers pay $97

We had 46 new sellers and seven returning sellers. These numbers are almost flipped from last quarter, where we had 41 returning sellers and just 11 new sellers.

This is pretty normal for us – nothing out of the ordinary here. Sellers that sold the previous quarter are usually busy working on their new projects and it can take anything from a couple of quarters to a couple of years to build up a new asset to sell with us again.

We are also seeing a lot more Fulfillment by Amazon (Amazon FBA) businesses specifically as we continuously cement our leadership in the Amazon FBA space, and are working to be leaders in the ecommerce space. We are attracting a whole new swathe of people that never realized they could sell their online businesses.

Investor Program

This could be the last quarterly report that mentions the investor program. Last quarter, we had a member of our management team leave to help run that side of the business but, alas, the venture has not been successful, and the earnings from the investment funds are down once more, coming in at just $3,359.63 in revenue.

We are now looking for ways to effectively exit the investment side of the business so that we can focus on deal flow. As we make a move to step away from the fund, we also want to do what is best for the investors, so more meetings will take place this quarter to decide the ultimate fate of the investor program and the next steps.

While the idea has a huge upside, it would appear it might be an opportunity that just isn’t for us — at least not for now.

Additional Revenue

Revenue that exists outside of the website and business brokerage is unlikely to go anywhere but down as we continue to redouble our focus and efforts on the actual brokerage itself. We have since stopped doing any affiliate promotions in favor of doing content collaborations that can help both our brand and a partner brand grow their audiences together.

Also, if we like something, we just promote it. No need for the hassle of setting up the affiliate links.

That being said, we did still bring in some revenue this quarter from other sources that totaled $127.61.

Traffic and Audience

Below are the numbers for our blog traffic, podcast downloads, and email list.

Blog Traffic and Analytics

As you can see right away, we had a BIG spike in April thanks to our Reddit AMA. The Reddit AMA sent so much traffic to us that the graph below looks almost depressing for the rest of the year. It’s worth pointing out that the peak shown here was 85,811 sessions.

We had a total of 259,170 visits this quarter, compared to 197,047 visitors last quarter. That’s a nice 24 percent bump in traffic for the quarter. Of course, a large part of that is from Reddit, so it remains to be seen if we can keep that momentum going in Q3.

Content marketing remains a big push for us. We use it to target keywords in Google organic search, but also as a way to get more influencers recommending us and ultimately to provide better education and knowledge to our customers.

A good example of knowledge-building content is an article written about how online businesses are migrated. While there was no real search engine optimization (SEO) benefit to writing this piece (at least not directly), there was a lot of benefit for our customers to read it, so they can understand better what to expect AFTER they have purchased a business.

Our SEO traffic increased by almost 8 percent from last quarter, but we saw a huge jump in direct traffic, with a 49 percent increase in people typing in our domain name right from their browsers. A large portion of this jump is likely from the publicity we got from our Reddit AMA, though a portion of it is also likely just brand growth. The more direct traffic we get, the more we can be sure that our name is getting out there and people are mentioning us to their peers.

Our average bounce rate remains good at a solid 52.72 percent. Our time on page metric, though, has decreased a little bit from last quarter when we were sitting at just under three minutes. The decrease is about 10 seconds, so likely not significant. Again, part of the decrease in page time is very likely because of the untargeted Reddit traffic hitting our site and bouncing right back off.

As we continue to scale our content further, we’re hoping to see even greater growth in these various channels.

Here are our Top 3 Most Visited Pages on Empire Flippers:

Here are our Top 3 Most Viewed Listings:

Here are our Top 3 Most Viewed Pieces of Content:

- The 11 Most Popular Online Business Models

- Want to Become an Apprentice? These Companies Are Looking for You

- Debate: Drop Shipping vs. Amazon FBA

Here are our Top 3 Most Viewed Recent Pieces of Content:

- How to Create Great Content that Ranks for Tons of Revenue Generating Keywords

- A Little Known Method to Removing Negative Reviews from Amazon FBA Product Listings

- How Internet Entrepreneurs Build Teams They Rely On

Podcast Downloads

In Q2, we saw 36,255 podcast downloads compared to 46,821 downloads last quarter. We did not publish a single podcast during the entire quarter for our main show, which is the primary cause of the decrease.

With the growth we’ve been experiencing at Empire Flippers it’s made it difficult to hop on the mic. We do miss doing the show, though, and will be getting at least a few episodes out this next quarter, for sure!

It is a testament to the quality of the content, though, that despite not publishing a single new podcast, we still received tens of thousands of downloads with people listening to our content.

It is likely this decrease will continue if our current podcast schedule remains the same. However, we are launching a new show in Q3 called “The Digital Journey”. We reached out to our audience and found two people to co-host the podcast for us that will add one more show under the Empire Flippers umbrella. The new show will launch this month and have a consistent weekly publishing schedule. With those changes, we should be able to grow in this channel again.

To be clear, the main Empire Flippers podcast and the Web Equity Show podcast will continue, and hopefully with more frequency this quarter. The Digital Journey podcast is in addition to our other two shows as we focus to continuously scale our content marketing arm.

Our second podcast, the Web Equity Show, saw 8,450 downloads this quarter, which is also down from last quarter. Though it’s worth mentioning that this quarter only saw the end of the third season, and not an entire season of the show like last quarter. Since the show is produced in seasons, the downloads fluctuate a bit more.

Email and Contacts

Our email list remains an important part of our business. If anything, our email system HubSpot is becoming even more important as we grow and try to attach attribution values to everyone coming into our sphere.

Currently, our active email subscriber base is 37,981, with growth of a couple thousand compared to last quarter, when we sat at 34,106 subscribers.

The relatively slow growth of our email list is surprising considering the boost in web traffic, but it could be because of the lack of opt-ins we have on the site. This lack is something we have tried to correct without being overly promotional.

We added an email opt-in to our marketplace, all of our listing pages, and our About Us page. The additions have grown our number of leads opting in, but not fast enough to see any major growth in our email numbers.

We are working on new lead magnets to use in hopes of attracting a larger email audience, and currently we are revamping our email newsletter to reflect the company as it sits today, rather than the way it was a couple years back.

For instance, we still have no-longer-used methods of payment being promoted within our email list. Not only do we have a few legacy issues here (such as talking about $30k-50k sites, which doesn’t reflect the majority of businesses anymore on our marketplace), we also really had only ONE email track for everyone.

As our audience has grown and diversified, there is a need to have more dynamic email sequences that can help our audience move forward with selling or buying businesses in their specific area.

All of this legacy work takes a lot of cleaning up, organizing, and time.

Still, we are VERY excited about the prospect of optimizing our email marketing and what fruit it might bear once we get it right.

We have also started segmenting our lists a little bit more so we can send specific content to you based on your interests, depending on whether you’re more intrigued by buying websites or by building out and selling websites. In fact, if you want to get specific content related to you, you can click the link below that best represents your interests and we will send you tailored content.

Which One Are You Interested In?

Click Here to share your buying interests

Click Here to share your selling interests

Customer Experience

Customer service is mission critical to our success as a brokerage and a marketplace. In Q2, we brought on three apprentices to help us handle the issues we were facing in the previous quarters.

The customer advisors we hired have helped us create new systems, implement those systems, and greatly increase our ability to serve our customers’ needs. While most of these systems are still new, they are bound to be improved with new iterations.

Our customer advisors have been able to segment our staff in the Philippines into three main sub-departments of operations:

- Vetting

- Customer Service

- Migrations

This operations change has been helpful in making our staff more specialized, stay in their lane, and improve the communications continuity.

Adding coverage, having updated systems in place, and breaking down the core parts of our operations have helped dramatically with our customer service. While it is still early, we are predicting that these changes will continue to have a profound positive impact on our business.

Zendesk Support

Zendesk remains our main workbench when it comes to interfacing with our customers. That is unlikely to change, as it solves the majority of our needs. Now with our new systems implemented, we hope to dramatically improve the customer experience.

Here are our numbers for Q2 2017:

We dropped our average first reply time by over an hour, going from 6.21 hours in Q1 to 4.59 hours in Q2. The Satisfaction rating saw a small drop from 94 percent to 92 percent, which is to be expected as we transition to the new systems we’ve created and perfect them.

New tickets continued to increase, as we expected, due to continued audience growth while the quarter progressed. There were 3,598 tickets in Q1 compared to 4,566 in Q2, almost a 1,000 ticket increase.

Customer Feedback

Now that we have new systems in place, and better response time, let’s look at how that has affected our actual feedback from customers.

Q2 2017: 4,566 new tickets, 4,254 solved tickets, 126 good ratings, five bad ratings.

The negative feedback we got was more varied this quarter than ever, and a bit more difficult to find since we had only five bad ratings, compared to Q1, where we had a whopping 32 bad ratings.

The bad ratings are a mix of annoyance dealing with typos, feeling out of the loop with new depositors, and being frustrated with submitted sites that didn’t pass our vetting. (Though one of the businesses actually DID pass its vetting, but the customer was under the impression that it didn’t, due to a communication error.)

The positive feedback mainly gave us compliments on being updated speedily and praise to our agents for their quick response time. We still have gaps to fix in the customer service operations, and we are making big leaps of progress on those gaps.

It will be interesting to see what Q3 looks like when all is said and done, as the new systems will have weathered more real life implementation by then.

What Happened in Q2 2017?

The highlight of the quarter, of course, was closing our biggest deal ever at $1.7 million. We all got together in Ho Chi Minh City, Vietnam, and celebrated for our biggest month in sales ever (over $3 million).

It was a good time, though obviously it took a lot of hard work to achieve that and we’re not resting on our laurels. Instead, we’re fired up to continue attracting bigger businesses to our marketplace.

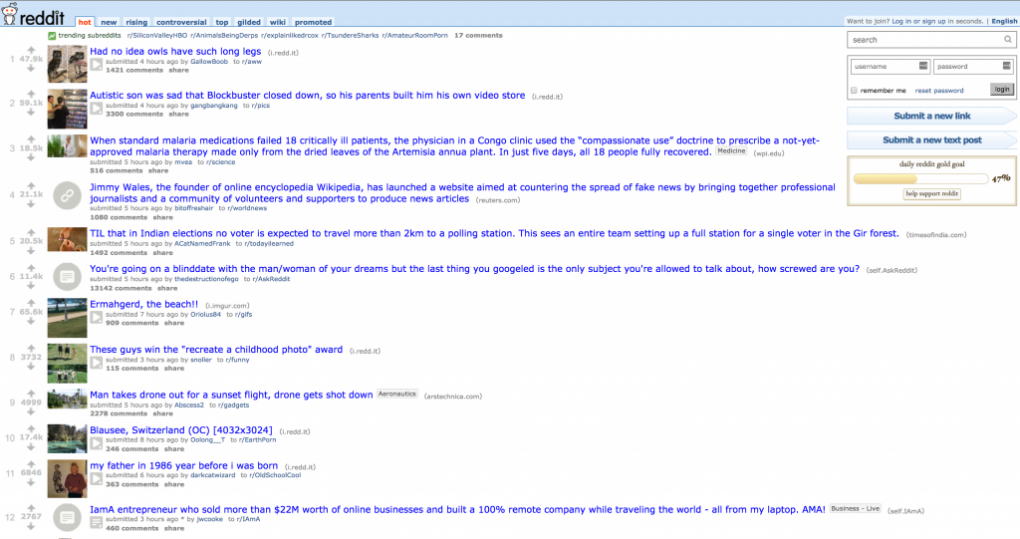

First Page of Reddit!

As you saw in our traffic report, we absolutely crushed a Reddit AMA. The Reddit AMA became so successful that we actually got to the homepage of Reddit itself at position #11! An owl with strange legs beat us out for Position #1, but even so the homepage exposure brought a ton of worthwhile traffic to our site.

Unfortunately, I didn’t get the screenshot for #11, but I did capture the screenshot when we got to position #12:

The visits were higher, but here’s a screenshot of Reddit sending us visitors:

In fact, we ended up having to pay extra for our hosting due to the amount of traffic Reddit was sending us. We also were able to list some fairly big businesses that first heard about us through that Reddit AMA.

Overall, it was a huge success and we look forward to doing another one. Of course, we can’t do a Reddit AMA every month, but we have found the AMA strategy to be pretty effective when it comes to promoting our business and brand to new audiences.

Three New Apprentices (and a Fourth)

Outside of our big month, we hired three new apprentices to fulfill our customer advisor roles. These roles have been crucial in revamping how our customer service is done and have alleviated a large pain point in the business for us. It looks like our service will only continue to get better as the new systems are implemented, tweaked, and perfected. This improvement should help our customers have a MUCH better experience with us when they come in to buy or sell a business.

In addition to the customer advisors, we also hired a content creator for our marketing department. His main role is optimizing several processes on our website, enhancing the content, and helping create high-quality video and audio for both our seller interviews and other multimedia projects. He was originally a contractor for us, but we realized we had a greater need than we first thought and decided to hire him outright.

You can check out our updated About Us page to see the new hires.

A Parade of Contractors to Leverage our Content Marketing Efforts

In addition to apprentices, we hired four new contractors in Q2 to help us grow our content marketing efforts, similarly to how Leadpages did by hiring a podcaster to run a podcast show for them. The idea here is that within six to 12 months, these contractors will be bringing in a steady amount of leads that will just keep coming in whether we do a new piece of content or not.

Unfortunately, one contractor has already fallen out, leaving just three.

One of the contractors will soon be taking over seller interviews from our content manager, which will free up more of the content manager’s time to focus on big picture projects.

The other two contractors will be hosting a hybrid YouTube and podcast show about entrepreneurship in the digital space, reviewing what makes entrepreneurs successful, and interviewing those in our space that are crushing it.

Overall, we hit our goals and it was a great quarter. There was a ton of work, a ton of new systems being implemented, and — despite this focus on our infrastructure — we were still able to grow significantly compared to last quarter.

As always, we owe a big THANK YOU to our audience for supporting us throughout the entirety of our journey. While these reports take a while to put together, I hope they’re helpful and inspiring to all of you out there. You can look through all of our old reports and see just how far we’ve come as a company, and hopefully that inspires you to see what is possible if you put in the required hard work.

Now back to you … what was your Q2 like? We’d love to hear what kinds of projects you’ve been working on!

Photo credit: urban_light

Discussion

I’m glad to see you guys are doing so well. Without a new podcast episode, I was thinking that you might be having a rough time of it – especially with the Amazon affiliate changes hitting site values, etc.

I rarely have time to read but have a ton of time for podcasts. That’s how I found you and why I’ve continued to follow you. I hope to hear you regularly again.

Best of luck,

Richard

Hey Richard!

Appreciate the kind words!

Yes, no podcasting this quarter definitely gave us a bit of a dip on the downloads. You’ll be pleased to know that Web Equity just wrapped up its latest season, and Justin is hard at work with two new podcast episodes coming out shortly (possibly three).

We are also working on a new project that will expand our podcast (and Youtube) audience we’ll be announcing soon, so keep in touch!

Hope you’re doing well with your projects and business Richard

Wow, very impressive . Good luck in next quarter!

Thanks! Looking forward to seeing what the next few months will be like!

You have really grown a lot since the last time I followed you closely, guys! Cheers for that. For me, you’re really the BEST when it comes to trusting anyone to be the middle man in such an important deal like selling your business.

Here’s to your next Q being even better!

Hey Alex!

Thank you for the kind words! It was an awesome quarter, looking forward to even more awesome year as we continue to grow and challenge ourselves to get to that next level with our business.

Hope everything is well on your end!